Key Trends in Lease Signings

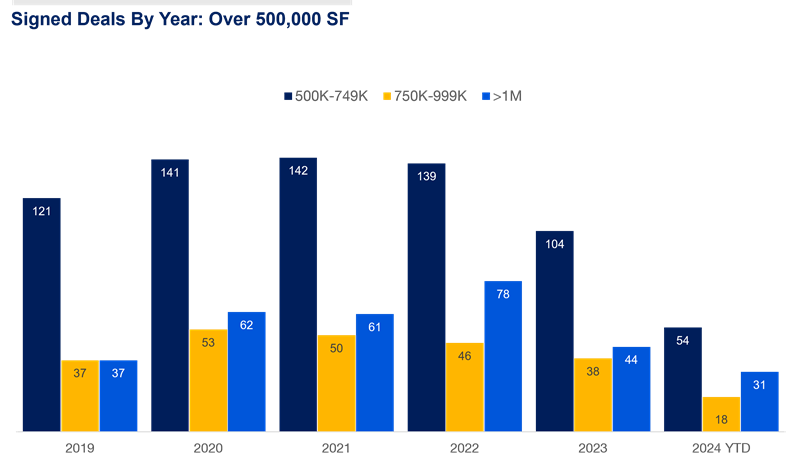

Lease activity for spaces between 500,000 and 999,999 square feet has seen a marked decline, while deals over 1 million square feet remain steady, though reduced from their pandemic peaks.

Availability and Market Conditions

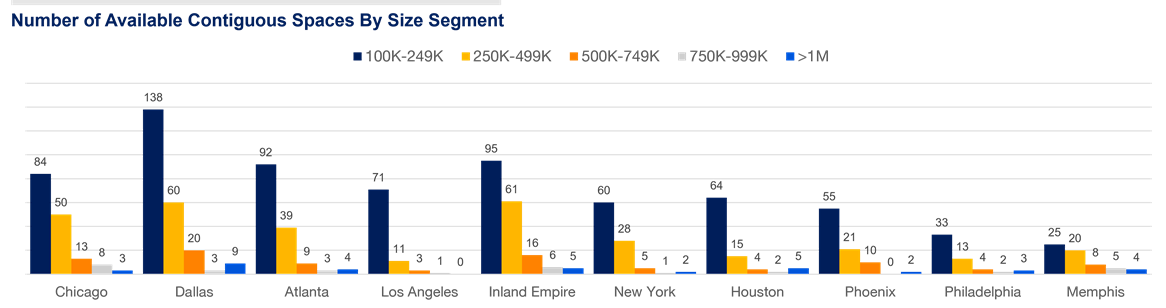

Recent data shows a 54.6% increase in available logistics space across the largest U.S. industrial markets since 2021. This availability surge, driven by both new construction and shifts in tenant demand, is presenting occupiers with more options and potential leverage in negotiations.

The total amount of available space increased in 9 out of the top 10 industrial logistics markets since the start of 2021. The most active markets in terms of new deliveries have seen the largest increase in the square footage of available space. Los Angeles, the Inland Empire, and New York markets have doubled the amount of available logistics space, while Houston has stayed relatively flat.

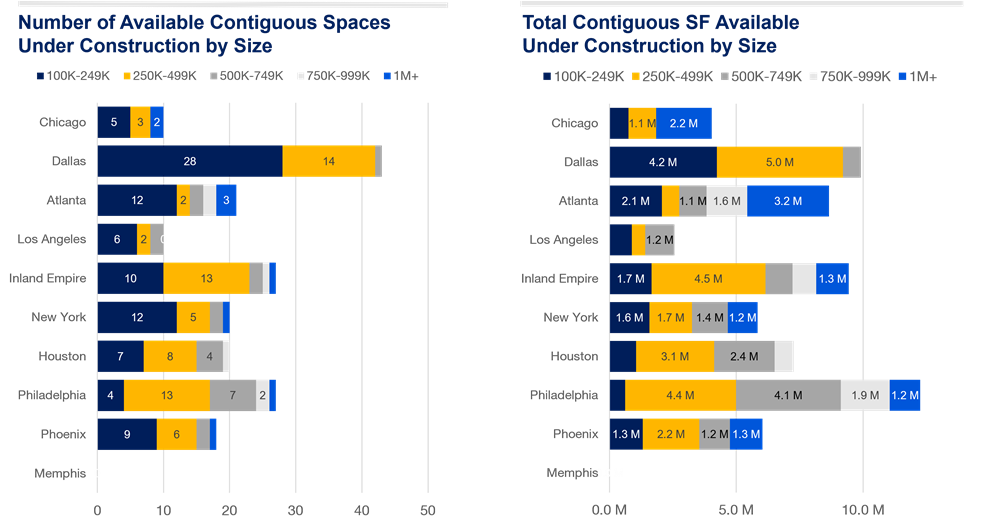

Top 10 Industrial Logistics Markets: Under Construction

New industrial logistics construction peaked in 2022. Starts for 2023 were comparable to pre-pandemic levels. In particular, the number of large projects, over 1,000,000 square feet, has fallen sharply. Atlanta has three available spaces over 1,000,000 square feet under construction, while the Chicago market has two. Dallas leads with the most availabilities in the smaller range (between 100,000 and 249,999 square feet), with 28 availabilities. Meanwhile, the Philadelphia has the broadest offering of availabilities of logistics spaces by size, with 13 spaces available in the 250,000 to 499,999 square foot range and 7 spaces in the 500,000 to 749,999 square foot range. n the 500,000 to 749,999 square foot range.

Impact on Industrial Occupier:

For tenants, these market conditions create new opportunities:

1. Negotiating Power: Increased space availability means landlords may be more flexible on lease terms, concessions, and rental rates. This is particularly true for spaces over 500,000 square feet where demand has waned.

2. Long-Term Planning: With the number of available spaces growing, especially in key logistics hubs like Dallas and the Inland Empire, businesses have a broader selection of properties to choose from. This allows tenants to be more selective, aligning their space needs more closely with future growth or contraction plans.

3. Under Construction Spaces: Markets like Dallas and Philadelphia also offer significant inventory in under-construction spaces, particularly for those seeking brand-new, state-of-the-art facilities. This includes a robust pipeline of mid-sized spaces, which can provide the flexibility many businesses now seek.

Conclusion

As we move into 2025, tenants in the industrial sector should consider the broader trends shaping the US logistics market. With more options available, occupiers will find more landlords willing to negotiate on rates, terms, and concessions. This is an opportune time to revisit space requirements and lease strategies to ensure alignment with long-term business goals. For businesses occupying commercial industrial space, being proactive and understanding these market dynamics will be key to making strategic real estate decisions in the year ahead.

For a more in-depth analysis of availability for warehouse/ distribution spaces download a PDF copy of the report, here.