The industrial sector continues to show growth, but at a significant shift downward amidst the dynamic changes in Atlanta’s real estate scene. Industrial real estate in Atlanta has been a steadfast pillar over the past few years, buoyed by the recent dominance of e-commerce, supply chain optimization, and Atlanta’s strategic positioning as a global logistics hub due to the continually growing Port of Savannah and booming traffic of Hartsfield-Jackson International Airport. This narrative gains even more attention and greater depth when considering the surge in population and job creation the market witnessed throughout 2023. However, beneath this success lies a story where the position of tenants as the “golden goose” are becoming pressured.

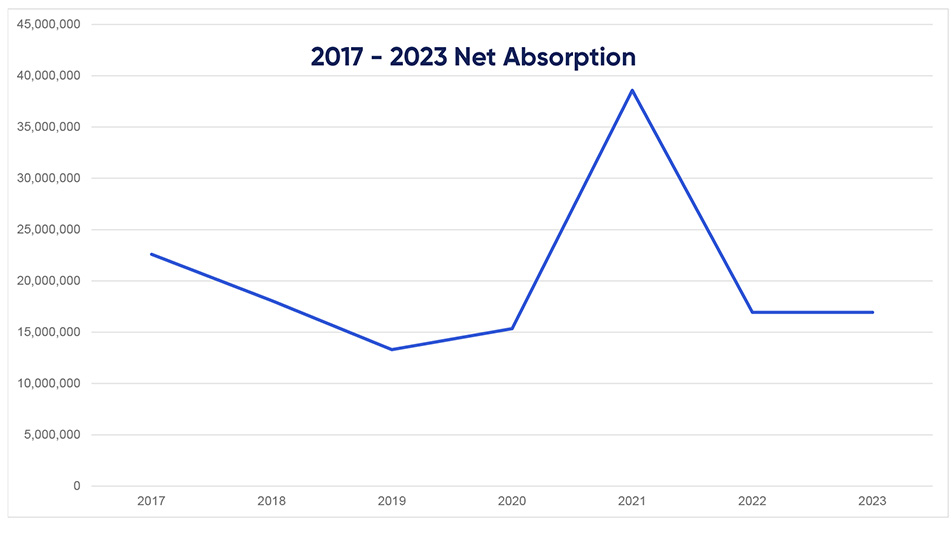

In 2023, the industrial sector displayed important metrics. 2023 showed a slowdown with a decrease in net absorption and a 6.2% vacancy rate. In 2020, net absorption was at 15,342,423 SF, while in 2023 it was 3,988,302 SF. Meanwhile, rental rates continue to climb along with an 88% increase in vacancy over the past three years. Notably, the emergence of 8.5 million SF of sublease space between 2021 and 2023 signals evolving dynamics. Occupiers have had very few options to turn to for lower rates, and the increase in subleases have given tenants lower cost alternatives that they have not had in the past.

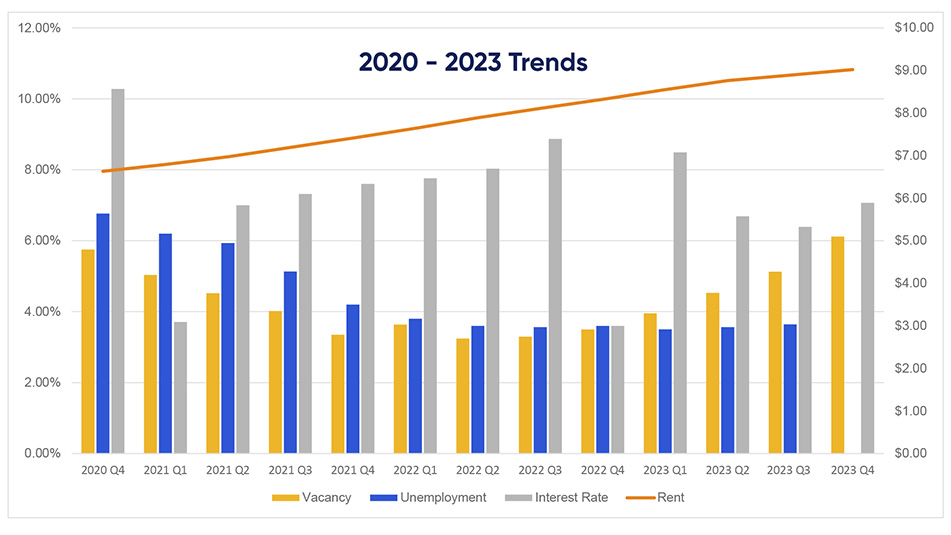

Coinciding with these metrics, rental rates have surged since 2020’s average of $6.63/SF to $9.02/SF in 2023 - an increase of $2.39 per square foot, imposing escalating pressure on tenants. To go along with these increases, labor costs have increased from 2020 to 2023 by 72% while unemployment has decreased over that same period from 6.7% at the end of 2020 to 3.7% by the end of 2023. Lastly, interest rates have risen substantially since 2020 where the average rate was 3.11% compared to 2023’s average of 6.67%. As rental rates, interest rates, and labor costs surge, landlords are intensifying constraints on tenants, recognizing their pivotal role as the cornerstone of the market.

In a landscape where occupiers are under pressures such as increased interest rates, labor costs, and rental rates, Cresa stands as an advocate, uniquely positioned to comprehend and address the multifaceted pressures they face. More tenants are considering sublease space and ownership as an alternative to coping with soaring lease rates. As tenants hold a significant position within the real estate ecosystem, landlords should take this matter seriously to avoid losing their golden goose. The delicate equilibrium between landlords and tenants must be preserved and is crucial for market sustainability.