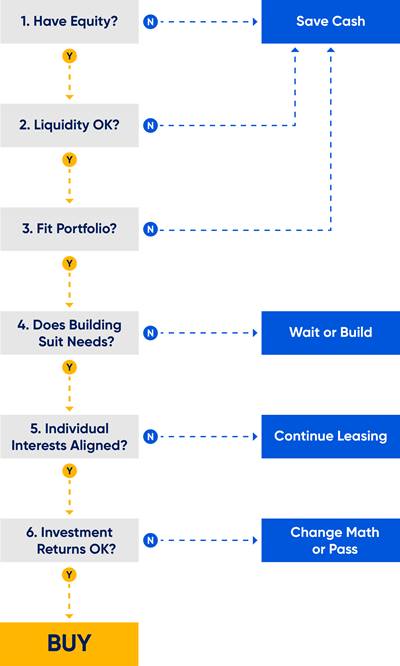

There just seems to be something inherently attractive about the ownership of real estate. Other financial assets - stocks, bonds, mutual funds and shares in private businesses - very often are evidenced only by numbers on a piece of paper from a financial institution or an accounting firm. Real estate, however, has a tangible quality. Buildings can be seen and touched, and that offers a sense of permanence that provides comfort not offered by other types of financial assets. The land on which a building rests is, by definition, something of which there is a limited supply, and the costs of the materials used to construct buildings tends to rise over time. Because of these and other factors, real estate has historically been viewed a hedge against inflation, and rightly so. Purchasing a property to house a business (vs continuing to pay money to others for rent ) is often the right thing to do, particularly for privately held companies. There are, however, factors that should be considered first, and these factors will be discussed here.

1) Have Equity? Like it or not, real estate ownership is a capital-intensive endeavor, and entering into this endeavor without adequate liquidity is a formula for disappointment and possible financial disaster. Most lending institutions require a minimum of 10% to 20% of the purchase price of a property (including any initial improvements) as a down payment. Lenders further require that the cash flow generated by the building occupants be adequate not only for service of debt, but also for reserves to cover potential maintenance issues. Debt coverage ratios of 1.1 to 1.2 are typical - in other words, net cash flow after property expenses should be 110% to 120% of debt service. If the owners-to-be do not have adequate cash on hand, they would be ill advised to proceed, plain and simple, and they should delay the move to ownership.

2) Liquidity OK? For all of its appealing attributes, one of the things that make real estate different from other financial assets is that real estate is not liquid. The owner of a stock or bond or share of a mutual fund can simply call up his broker and sell with little effort at the price currently offered by the market. Not so, real estate. From the time a property owner makes the decision to sell, the transfer in a best-case scenario would take place in three to six months given the need for a buyer to be identified and for that buyer to obtain financing and undertake the necessary due diligence before closing on the property. It is not at all uncommon for properties, especially non-generic or poorly located properties to remain on the market for 12-36 months. Anyone contemplating the purchase of a property for a business should be in a position to have his or her equity investment tied up not only during the occupancy period, but also during a potentially lengthy disposition period. Ownership of real estate is not for the financially faint of heart.

3) Fit Portfolio? An equity investment in real estate should be considered in light of the other investments in the owner's personal portfolio. Any business owner contemplating the purchase of a property to house that business should first seek the advice of a trusted financial adviser to be sure that the equity required will not throw his of her personal portfolio out of balance with real estate making up an inappropriately large proportion.

4) Does the Building Suit Your Company's Needs? Does the property under consideration suit the business needs of the company to be housed there? This may seem an obvious point, but in my experience once there is momentum toward purchasing and away from leasing, the rationalization process is often well underway. Such, apparently, is the emotional attachment to the idea of owning real estate. Is the property under consideration located reasonably near the homes of existing employees? Can it accommodate growth for the foreseeable future? Does the layout of the space work ? There are literally dozens of questions like this that should be answered and yet many an otherwise-smart businessperson has been so blinded by the "great deal" offered on a particular building that they discover only after moving in that that "perfect" property does not suit the practical day-to-day needs of their company.

5) Are Individual Interests Aligned? Ownership changes in privately held companies are very common. New partners are brought into the fold based on their ability to contribute to the success of the firm. These new partners many be brought from outside the firm to gain access to new markets and/or to gain market share, or they may be promoted from among existing employees as a means of retaining important contributors. Because of tax advantages, most companies that purchase properties to house their businesses set up separate corporate entities with an investment entity as landlord and an operating entity as tenant. Before moving forward with the purchase of a property there should be reasonable certainty that the same key individual players will be principals in both entities for the period of ownership of the building. Otherwise, very direct conflicts will surely arise in the future. Consider, for example, that the income statement interests of the individuals in the operating entity would best be served by a low rental rate, which would result in higher profits to distribute to those owners. Meanwhile, the balance sheet interests of the individuals in the investment entity would best be served by a high rental rate, which would result in a higher investment value for those owners. Further complicating matters, the cost to buy into the real estate investment entity could make buying into the operating entity cost prohibitive for younger partners-to-be. These matters can get quite interpersonally complicated and can lead to serious morale problems.

6) Are the Investment Returns OK? The equity investment in an owner/occupied property should provide returns that are competitive on a risk adjusted basis with alternative investment and/or should provide for diversification of the owners personal portfolio. Otherwise, for any given building the rent must be higher, or the purchase price and/or loan terms must be lower.

Once these hurdle issues have been resolved, the search for a property can get under way.