A Tale of Two Property Sectors

Mixed economic signals have caused organizations to be cautious. Low unemployment and strong job creation have been set against high inflation and rising interest rates. Long-awaited wage gains have been eroded by rising prices, but pent-up demand has caused strong consumer spending.

Office Market

After two years of uncertainty, the hybrid work model has emerged as the most popular approach for office tenants. The result has been a precipitous drop in demand for office space. Newly delivered office buildings and the accompanying amenities and ability to meet contemporary demands have been successful.

Industrial Market

Threats of an impending recession are becoming clearer, but economic drivers remain positive heading into 2023. Inflation-adjusted retail goods and truck tonnage remain at historic high levels, providing an optimistic setting for continued demand.

The Economy

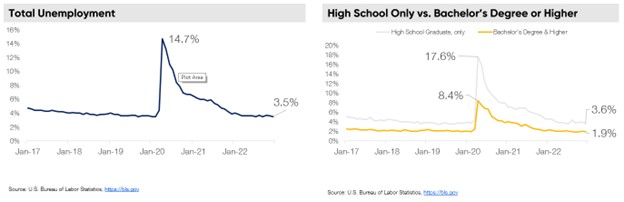

Unemployment Returns to Pre-Pandemic Levels

Despite economic headwinds, unemployment remains near historic lows. Continued Fed rate increases are expected to continue, albeit at a slower pace, coupled with high inflation, which will likely push unemployment higher.

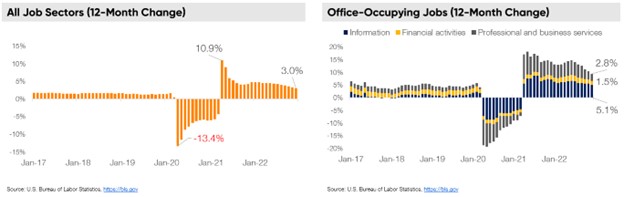

Job Creation Continues Despite Economic Headwinds

Low unemployment is being spurred by strong job creation, but companies are having difficulty filling the 10.5 million job opening reported by the Bureau of Labor Statistics. Additionally, the number of people that left the job market during the pandemic has been slow to re-enter the labor force, causing a slightly blurred image of the recovery.

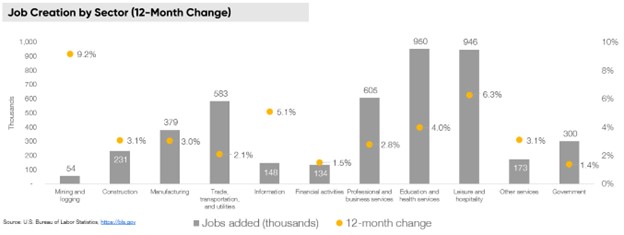

Hospitality and Health Services Lead the Way

Pent-up demand leads to increases in leisure and hospitality and education and health services sector jobs. Industrial-related jobs also posted big gains as consumer demand and supply chain issues continue.

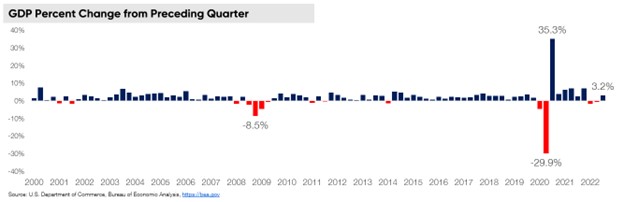

Gross Domestic Product

The Gross Domestic Product ended the third quarter up a surprising 3.2 percent, after two-quarters of negative growth. The strong growth was supported by increases in exports and consumer spending, stalling a sustained period of weak or negative growth that results in a recessionary period.

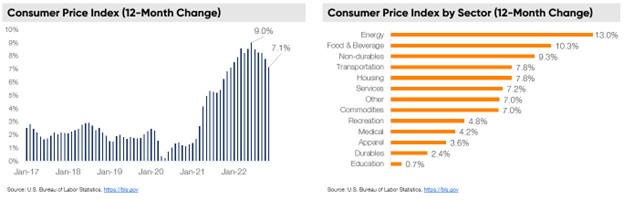

Inflation Begins to Slow, but Still High

Driven by consumer demand, supply chain disruptions and a tight labor market, inflation has pushed prices higher throughout 2022. Rapidly increasing food prices, along with higher energy costs have been one of the main drivers in increasing inflation. While the rate of increase in the CPI is beginning to slow, prices have eroded by recent increases in standards of living.

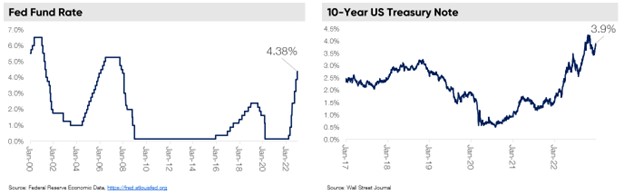

Rates Continue to Rise as Fed Attempts to Control Inflation

A series of increases in the Fed rate, including three 75bps increases in 2022, has bumped the range to 4.25% to 4.50%, the highest level in 15 years. Meanwhile, the 10-year US treasury note, an indicator for broader investment confidence, has generally increased ending the year at 3.54%. Rates haven’t reached this level before the pandemic since 2011.

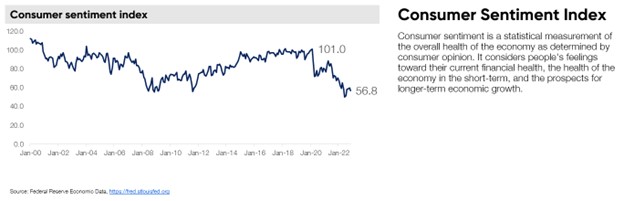

Consumer Sentiment Remains Near Decade Low

Despite strong consumer spending related to pent-up demand, the consumer sentiment index has dropped precipitously since the beginning of the pandemic. Given rapidly rising prices due to inflation, consumer spending will likely begin to tighten.

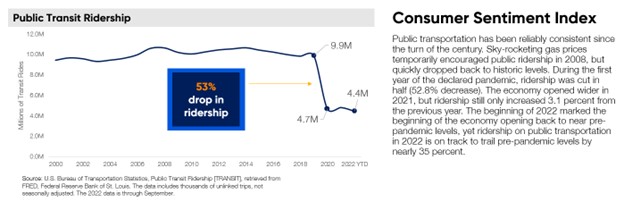

Public Transit Still Greatly Lags Pre-Pandemic Levels

A good indicator of the health of an urban core, and by extension the downtown office market, is the use of public transportation. While trending in the right direction, public transportation is still struggling.

Real Estate Trends: The new normal is disruption.

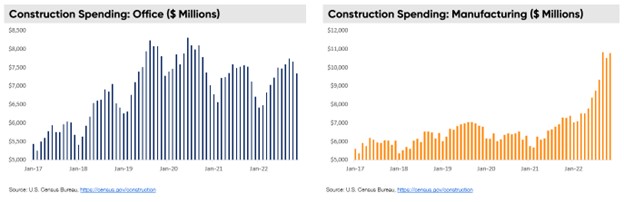

Office Construction Spending Falls, While Industrial Spending Increases

Office construction is beginning to fall as projects started pre-pandemic deliver. It is expected that spending will fall further as demand wanes.

Construction in manufacturing has exploded as the need for space has climbed sharply. Spending has more than doubled since the start of the pandemic.

Housing Starts Taper, as Rising Interest Rates Slow the Market

The number of residential housing starts soared since the start of the pandemic, while the number of homes sold reached record highs in both 2020 and 2021. This demand drove prices higher. This growth is being tempered as mortgage rates increase. Meanwhile, prices have begun to fall as demand softens.

Commercial Trends

As office-occupying companies vacillate between edicts of returning to the office and work-from-home models, many organizations are taking a measured approach. The softening economy is making matters increasingly cloudy for decision-makers as they consider right-sizing their space. Meanwhile, occupiers of industrial space are still navigating an imbalance of supply and demand. Record warehouse/distribution construction may provide some relief as new spec developments begin to deliver.

Office

• Asking rates flat

• Concessions/TIs increase

• Vacancy increases

Industrial

• Rates continue steady rise

• Vacancy near historic lows

• Construction peaks

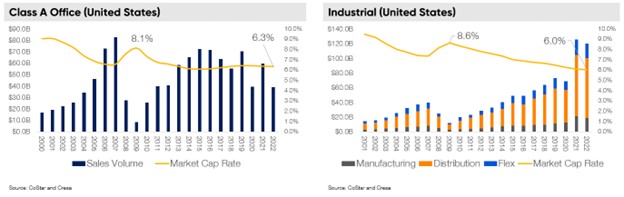

Capital Markets: Class A Office Volume Falls, While Demand for Industrial Properties Climb

Class A office sales volume dropped after an uptick in 2021. Cap rates have remained flat as prices for quality buildings have held during the pandemic.

Strong demand has caused industrial sales volume to nearly double in the year following the Covid lockdown. As a result, cap rates have fallen to the lowest level in 20 years.

Office Rents Remain Flat, as Industrial Rents Hit Historic Highs

Office rates have stayed flat over the past three years, but nominal lease rates have gone down as inflation has increased other costs.

Industrial rates have increased steeply since the end of 2020, particularly distribution space, which has increased by 18.7 percent in the past two years.

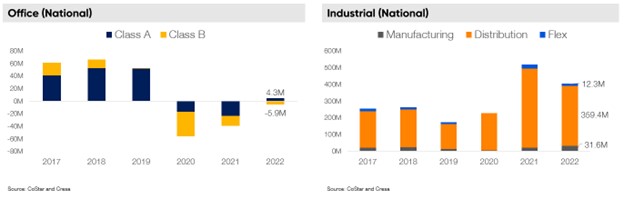

Office Absorption Recovers, as New Deliveries Drive Industrial Absorption

Work-from-home policies have caused many companies to reevaluate their existing office footprint. As organizations right-size, office absorption has been overwhelmingly negative.

In 2021 absorption reached over 500 million square feet, a historic high. New construction deliveries are expected to continue to push levels well above historic averages.

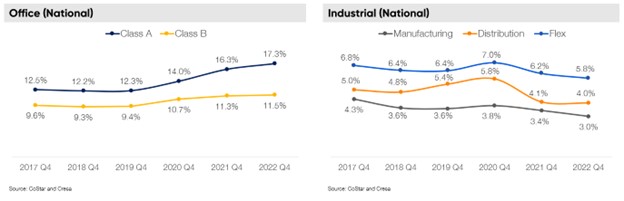

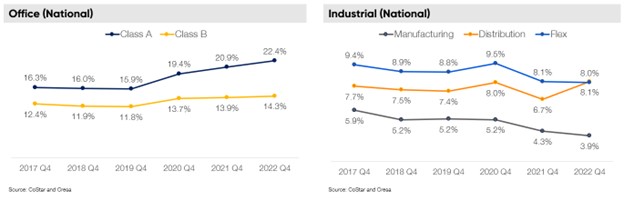

Office Vacancy Spikes, While Industrial Vacancy Continues to Compress

Class A direct vacancy has increased at a faster pace compared to Class B space. Direct vacancy is expected to continue to rise as pre-pandemic signed leases begin to roll.

Direct vacancy within the industrial market has dropped for three straight years, with distribution properties falling to historic lows.

Availability Climbs in Class A Office Space, Industrial Availability Steady

The availability rate includes the amount of space that is being marketed as available for lease, regardless of whether the space is vacant, occupied, available for sublease or available at a future date. Therefore, the availability rate may be a more accurate depiction of the market during this volatile period than the direct vacancy rate.

Office Construction Tapers, While Industrial Projects Continue to Break Ground

As pre-pandemic office projects deliver, the amount of under-construction space will drop. Demand and the cost of construction materials will likely stall many office projects.

Under construction industrial projects reached 675 million square feet in 2022, a historic high. However, as interest rates increase developers will likely pull back moderately.