Trending Now: Workplace Flexibility

First Published on DMagazine.com

By now, we have all been inundated with news about the coronavirus, social distancing, and economic shutdowns. Unfortunately for commercial real estate, the industry may still not be realizing the full effects of this pandemic.

The concern on many CRE professional’s minds is: “will workers return to the office just as before?” There’s been a massive flood of articles and studies showing a variety of potential outcomes. I’ll be looking at some of the most popular studies done and show some of our research on COVID-19’s potential future impact.

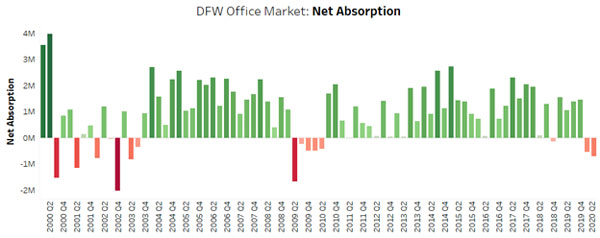

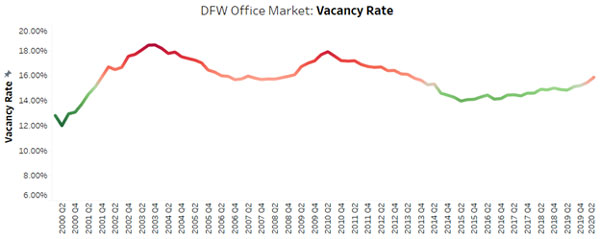

Let’s set the stage by looking at some basic Costar figures for the Dallas-Fort Worth office market, including net absorption and vacancy trends from 2000 to 2020.

It’s quick to see that both absorption and vacancy are trending into the red – but not as bad as the dot com bubble or ‘08 financial crisis … yet. If you take a closer look, CRE always lags when economic hardship strikes. We won’t know the full effects of COVID-19 on the office market until we’re further down the road.

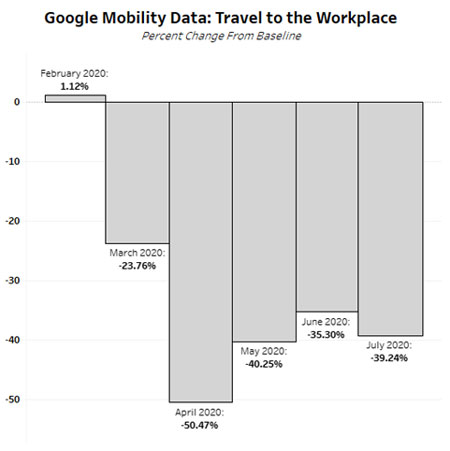

Let’s dive deeper and look at how people are responding to the pandemic in terms of geographic mobility using Google’s data.

For those of you unaware, Google (and others) are tracking our location at basically all times. This dataset is in response to COVID-19 and helps communities understand their population’s mobility to grocery stores, retail, workplaces, and more. The graph above is visualizing the average movement to and from workplaces for Denton, Dallas, Tarrant, and Collin Counties. It’s not surprising that starting back in March, you see a considerable dip in mobility to the workplace. As of July 31, mobility has improved, yet a 39 percent drop from the baseline for July is still extreme. As the population returns to the workplace post-pandemic, these numbers will give us greater insight into whether we return pre-pandemic normalcy for workplace usage.

Okay — so what are the industry experts telling us? Is there a consensus among different studies and surveys on how employees want to work?

According to Gensler’s 2020 U.S. Work from Home Survey, 30 percent of people want a “flexible work arrangement,” meaning 3-plus days working from home per week. If we look at another study from IBM, 54 percent of adults would rather work most of the week remotely.

These numbers are higher than some might expect and can be alarming for those depending on consistent office space demand. Fortunately, there’s a caveat: employees are not happy working from home 100 percent of the time. A common complaint is a lack of collaboration and the social energy an office space brings to employees.

A study from Stanford University that used 500 employees in a work from home experiment concluded that “more than half the volunteer group changed their minds about working from home 100 percent of the time—they felt too much isolation.” Cresa ran a similar survey and found that 67 percent of employees ranked collaboration in their top 3 when asked what they missed about the office during the pandemic.

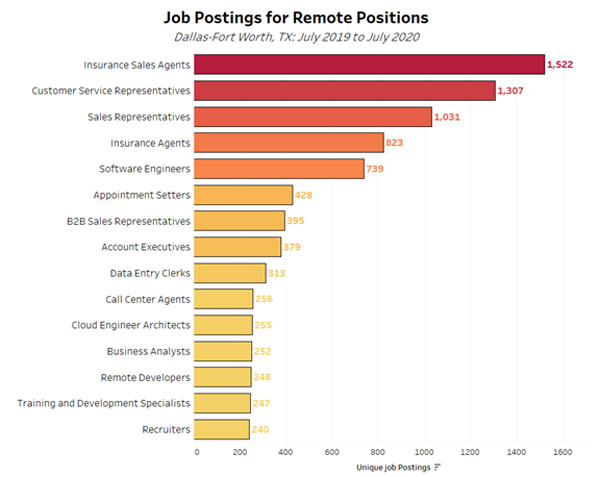

So, what happens if more companies adopt a more permanent work from home culture? Which jobs are more susceptible to even more remote work?

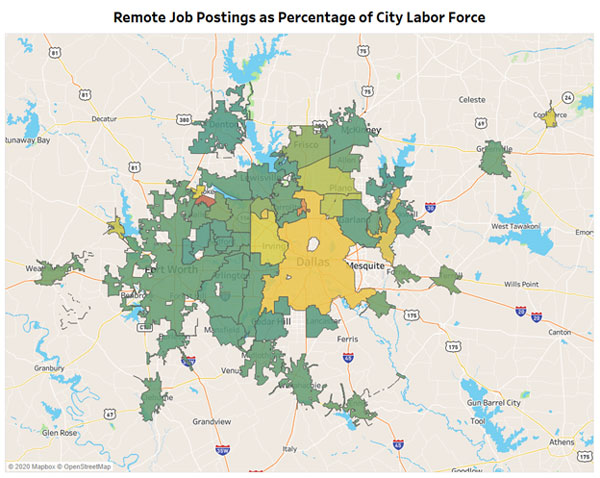

The graph above tells us which positions are being advertised in job postings as “remote.” It should come as no surprise—sales, customer service, and technology jobs are easier than ever to manage from a home office. For the sake of curiosity, let’s assume that even more of these roles are moved to a more flexible work schedule post-pandemic. The question presented is, “Which geographic areas may be affected, and will that affect office space demand in those areas?”

This map highlights cities in which there is a high number of job postings for remote positions as a percentage of the city’s labor force. Meaning, these are cities in which there are more remote workers than usual (red being higher than average and green being lower than usual). Westlake, Addison, and Dallas have high percentages, whereas Denton, Haltom City, and North Richland Hills are showing very low percentages of remote workers.

Moving forward, every company decision-maker, C-suite executive, IT, HR, and real estate director, has to assess the impacts of COVID-19 on their business, workforce, and workplace. It is crucial to have a trusted CRE advisor to help navigate these precarious times to be better prepared for tomorrow.

With the help of workplace strategists, data consultants, and industry experts, a proper roadmap can be drawn up to determine, “What does the future look like for my organization?” Numerous tools can be leveraged to reevaluate your office footprint, your space usage, and how it relates to your company culture. As information continues being gathered, additional benchmarks and trends are emerging. As companies forge ahead, there is at least one certainty; failure to act is not an option.

Hunter McGuinness is the vice president of consulting services in the Dallas office of Cresa