Global Pandemic & Falling Oil Prices Ensure Market Remains Occupier Friendly

The first quarter of 2020 took many by surprise, with occupiers dealing with the many challenges spurred on by the COVID-19 outbreak. To make matters worse, oil prices are falling once again due to both reduced demand sapped by the global pandemic and a price war with the falling out of OPEC+ oil cartel and Russia.

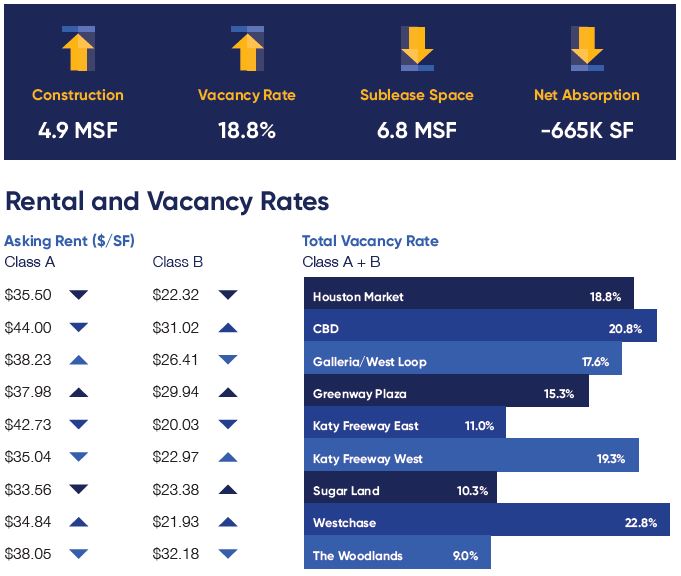

While it’s far too early to have seen any meaningful direct impacts from these economic disruptions, the market posted significant negative absorption of 665K SF in direct space last quarter, elevating direct office vacancy to 19% across the metro. Available sublease space did fall by more than 1.3M SF, but that was primarily from Occidental Petroleum pulling over 500K SF from the sublease market in Greenway Plaza.

Overall, leasing activity was down about 200K SF in the first quarter compared to the same quarter in 2019. And with most businesses only now slowly beginning to fully reopen and facing oil prices at 20-year lows, we can expect to see a further weakening in demand and an increase in sublease space as we could see a rash of bankruptcies and consolidations in the energy sector. Landlords will be pressed to be more aggressive with competitive rates and generous concession packages in what was already a very occupier friendly market.