Please find June's edition of my monthly update on the North Dallas-Plano-Frisco office market detailing the latest office tenant and building news as well as lease transactions recently signed.

If you have an office decision to make, please contact me for help with your real estate needs.

Metro, State and National Office Market News

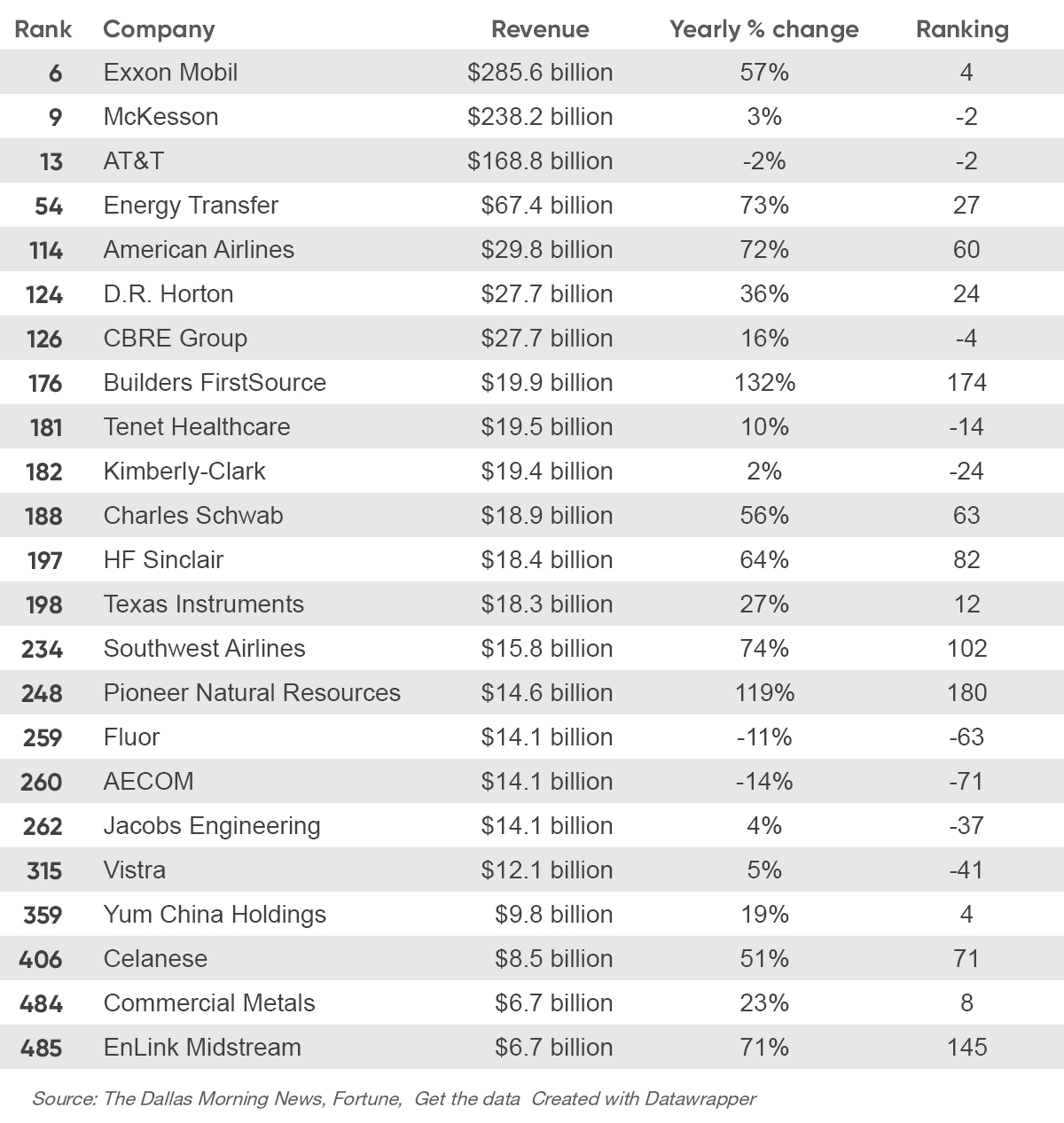

Twenty-three public companies that call DFW home earned spots on the newly-released 2022 Fortune 500 ranking of America’s biggest corporations, which is one more than last year. Engineering giant AECOM joined two of its biggest competitors when it relocated its headquarters from Los Angeles to North Texas in August 2021. Fortune’s annual ranking, which is based on revenue generated in the previous year, showed 2021 was an excellent year to be in the oil and gas or real estate business, with some industry giants posting triple-digit increases in year-over-year revenue. Exxon Mobil regained its perennial spot as the revenue leader in both DFW and Texas, although the company recently announced that it will relocate its headquarters to Houston by mid-2023 to its massive 385-acre campus in Spring. Fortune’s ranking actually goes up to 1,000 companies, with 19 additional DFW companies scoring spots in the second 500 grouping.

Twenty-three North Texas-based companies scored spots on this year's ranking of the nation's largest public companies based on revenue.

The volume of sale-leaseback transactions has ballooned by 190% over Q1 2021, which represents the strongest Q1 on record. Sale-leasebacks plummeted in 2020 during the pandemic due primarily to an uncertainty companies had related to the future of the workplace and potential for shrinking footprints, but began to surge in popularity by mid-2021. Q1 2022’s $8.4 billion in leaseback transactions was above Q4 2021, but below Q3 2021 when $9.5 billion was transacted. The average capitalization rates for sale-leaseback transactions have been in the 6% to 8% range, which is generally well inside many companies’ weighted-average costs of capital and, therefore, this tool will continue to be an attractive option on the corporate financing side. Regionally speaking, the West portion of the country continues to see the majority of sale-leaseback transactions, accounting for 62% of deal volume in Q1 2022, followed by 16% in both the South and Northeast regions and the Midwest seeing only 5% of the deal volume.

Apple, the world’s largest tech company, is stretching its vast real estate portfolio even further in a sign of the global tech giant’s aim to get its employees back to physical offices. The Silicon Valley-based company signed a two-building, 382,000 square foot lease in Sunnyvale, California, representing the latest signal by Bay Area tech giants affirming their commitment to physical space as their influence increases over the commercial real estate market. The newly-leased campus comes roughly one year after Apple signed one of Silicon Valley’s largest COVID-era office lease deals in May 2021 when they took 700,000 square feet across six buildings in Sunnyvale. Apple, along with other companies across the country, struggles to balance its goal to get employees back to physical offices against worker demands for a more flexible schedule. Last month, Apple postponed its requirement that workers return to the office for a minimum of three days per week due to the latest surge in COVID-19 cases.

Apple's Mathilda Commons Campus in Sunnyvale, CA (Source: CoStar)

Chicago-based industrial giant Caterpillar Inc. has announced it will relocate its global headquarters from suburban Chicago to Irving. The company currently has 120 workers in an 81,509 square foot office in Las Colinas’ Williams Square. A company spokesperson commented that most of the 230 positions at its Deerfield, Illinois, headquarters will transition to the new Las Colinas office. The international manufacturer of construction and mining equipment, engines, generators and locomotives has had a presence in Texas since the 1960s. Caterpillar, which posted $51 billion in revenue in 2021, will become the fifth-largest public company headquartered in DFW, trailing only Exxon Mobil, McKesson, AT&T and Energy Transfer. Caterpillar did not request any economic incentives related to the headquarters move.

The Towers at Williams Square (Source: CoStar)

Dallas City Council has voted to approve more than $18 million in economic development incentives to investment bank Goldman Sachs and Hunt Realty Investments, the local developer behind a key tract of land in Dallas’ urban core that could help win a major employment hub for the financial giant. The incentives package abates 50% of the property taxes on the estimated $390 million campus over a period of 10 years and 50% of the estimated $90 million in business personal property over a period of 5 years along with offering a $4.4 million grant for job creation and expedited permitting costs. Those tax savings equate to $1.7 million for Goldman Sachs over the five-year period and $15 million for Hunt Realty over the 10-year period. In exchange for the incentives package, Goldman Sachs has agreed to double its local workforce by retaining the 2,500 employees housed at its office in Trammell Crow Center in downtown Dallas and adding another 2,500 jobs by the end of 2028. Employees will have an average base salary of $90,000. Goldman Sachs also must sign a minimum 15-year lease for at least 800,000 square feet in a newly-constructed office tower on an 11-acre site along N. Field Street, north of Woodall Rodgers Freeway, that is currently home to low-rise apartments. The tax breaks will be part of a proposed state neighborhood empowerment zone.

Goldman Sachs' Proposed Uptown Site to the right of Perot Museum (Source: CoStar)

The office building will be developed by Hunt Realty, which anticipates investing $390 million in real property improvements for the construction of the new building, which could be completed by December 2028. Goldman Sachs expects to invest a minimum of $90 million in business personal property, including tenant improvements and furniture, fixtures and equipment. The office building is part of Hunt Realty’s master plan that includes more than 3.7 million square feet of commercial real estate with an urban arboretum-like park. Hunt’s proposed development plans are in response to “a real tidal wave” of development and corporate relocations expected to hit the DFW region. Goldman Sachs calls the DFW area its second-largest employment hub outside New York City with about 4,000 employees locally, occupying a 200,000 square foot block of office space at Trammell Crow Center in downtown Dallas and an 89,000 square foot block of office space in Richardson.

Rendering of Hunt Realty's Goldman Sachs Uptown Development (Source: CoStar)

Dallas-based luxury retailer Neiman Marcus Group is the eligible recipient of $5.25 million in economic incentives should the retailer agree to employ at least 1,400 workers in Dallas and maintain its flagship store downtown in the city where it started more than a century ago. Dallas City Council voted 7-6 to provide a Chapter 380 grant totaling $5 million tied to the company retaining a minimum of 1,100 jobs and creating at least 300 jobs in addition to approving up to $250,000 of reimbursements for expedited permitting and other construction-related fees. Neiman Marcus has been designing its new headquarters around a hybrid workforce after drastically reducing its office footprint in Dallas and reorganizing its business.

Neiman Marcus Flagship Store in Downtown Dallas (Source: CoStar)

Far North Dallas Office Submarket News

Los Angeles-based private real estate investment firm WealthStone has brought 8454 Parkwood Boulevard out to market for sale. The 2-story, 40,000 square foot, Class “A” office building, which was constructed in 2016 in the southeast quadrant of State Highway 121 and Parkwood Boulevard, is 100% leased to an investment-grade credit tenant (C.H. Robinson) on a NNN lease basis with 2.5% annual rent escalations through May 2030. C.H. Robinson is a Fortune 200 third-party logistics provider headquartered in Eden Prairie, Minnesota. WealthStone acquired the property in May 2020 and has taken it out to market with an asking price of $18,495,000 or $462 per square foot on a 5.25% capitalization rate.

8454 Parkwood Boulevard (Source: CoStar)

San Francisco-based private real estate investor and developer Drawbridge Realty Trust has acquired 5301 Headquarters Drive (HQ53) in the Legacy market from Dallas-based developer Cawley Partners. The 5-story, 248,661 square foot Class “A” office building, which was constructed in 2021 at the northwest corner of Headquarters Drive and Belleview Drive just south of State Highway 121, is 100% leased to Aimbridge Hospitality, one of the world’s largest third-party hotel management firms, on a NNN lease basis through February 2034. Aimbridge currently manages a portfolio of more than 1,500 hotels and resorts in 50 states and 23 countries. After moving into the building upon completion in 2021, Aimbridge is now marketing for sublease 75,946 square feet on the 1st and 2nd floors at $35.00/NNN. The property was expected to sell for approximately $130 million or $523 per square foot, which would be a near record per square foot price for the Legacy market. Drawbridge’s acquisition financing for the property, via Forethought Life Insurance Company, amounted to $84,862,500, which equates to $341 per square foot.

HQ53 at 5301 Headquarters Drive (Source: CoStar)

Eighteen months after emerging from a bankruptcy protection filing, Plano-based J.C. Penney has executed a 300,000 square foot office lease to move back into its former headquarters building, which has since been renamed The Campus at Legacy West. The retailer will occupy just a fraction of the space it once occupied when the 1.8 million square foot office campus was originally constructed for J.C. Penney in 1992. The company walked away from its long-term lease at The Campus at Legacy West in 2020 after filing for Chapter 11 bankruptcy. Since then, employees have been working in temporary offices, including a vacant J.C. Penney department store in Lewisville. The retailer expects to move into its new permanent home in the 4th quarter of this year. J.C. Penney sold its campus to Dallas-based Silos Harvesting Partners in 2016 as part of a $353 million sale-leaseback transaction. After J.C. Penney vacated the building in 2020, Silos lost the property to Beal Bank in a foreclosure. One year later, Austin-based real estate investment firm Capital Commercial Investments, which has a history of redeveloping large office campuses and transforming them into corporate magnets, purchased the campus out of foreclosure and has been working in concert with the city of Plano on a new master plan for the sprawling 55-acre property.

The Campus at Legacy West (Source: CoStar)

Mexican frozen food manufacturer Ruiz Foods has signed a 24,896 square foot lease to occupy the entire 3rd floor in Hall Park’s 3001 Dallas Parkway building, which is located in the southwest quadrant of the Dallas North Tollway and Warren Parkway. The company’s senior executive team plans to relocate to the Frisco location, which will become a new regional headquarters, when they occupy the office in June. The move will place company executives closer to its product packaging plant, which is situated 60 miles north in Denison. Dan Antonelli, president and CEO of Ruiz Food Products, remarked on the “need for a centrally located regional headquarters in a larger metropolitan area” and believes Frisco “will allow for greater business opportunities, more efficient access to each of our facilities and easier recruitment of talent with important skill sets, such as consumer products, IT and marketing experience.” Ruiz Foods expects to house 125 employees in the Frisco office by 2026.

Hall Park's 3001 Dallas Parkway (Source: CoStar)

Plano-based digital fitness systems company OxeFit has announced new funding, which brings its total to $35 million following a $12.5 million Series A round led by Plano- and Florida-based Lydia Partners in February. With the new funding from backers including PGA golfer Dustin Johnson and Los Angeles Rams cornerback Jalen Ramsey, the list of celebrity athletes backing OxeFit includes current and former Dallas Cowboys players Dak Prescott, Jason Witten, Dez Bryant and Blake Jarwin. Combining artificial intelligence and robotics, OxeFit’s technology offers users different strength training and cardio workout options as well as software to track user motions to provide feedback, customize training and track fitness goals.

Private investor Noel Yi has purchased 8131 LBJ Freeway, which comprises an 8-story, 227,891 square foot office tower in the northwest quadrant of LBJ Freeway and North Central Expressway in Dallas, from Arlington-based SkyWalker Property Partners. SkyWalker acquired the building in February 2019 from Credit Union of Texas and invested $1.3 million into upgrading the property. The building was 61% leased at the time of the sale. Yi acquired the property using funds from a 1031 tax exchange.

Site work has begun on the construction of a $141 million, 15-story office building along the Dallas North Tollway as part of the $1.5 billion The Star mixed-use development in Frisco. The 525,000 square foot, Class “AA” high-rise tower has been fully leased to New York-based Teachers Insurance and Annuity Association (TIAA), which is one of the nation's largest pension funds and financial advisers. TIAA recently announced that it would bring 2,000 jobs to the Frisco project when the building is completed in 2024. In the deal, TIAA and its real estate division Nuveen Real Estate will co-develop and manage the property. TIAA will commit $58 million in finishing out and furnishing the new office space while also receiving an $18 million grant from the Texas Enterprise Fund to help pay for the Frisco office. The new office is scheduled to open when the building is delivered in 2024 and will be fully staffed by 2029. The Fortune 100 firm currently has $1.4 trillion in assets under management and pays billions in annual benefits to its clients, which are primarily retired educators. TIAA currently has an office in Lewisville, which will relocate to The Star upon opening and will be staffed with a range of client relations, service and technology roles.

Plano-based fast casual restaurant chain Velvet Taco has executed a 10,600 square foot office lease to relocate its headquarters to The Commons (15110 Dallas Parkway), which is located at the northeast corner of the Dallas North Tollway and Belt Line Road in north Dallas. The 6-story, 92,308 square foot office building was originally constructed in 1983 and is currently 76.4% leased. Houston-based investment firm Triten Real Estate Partners acquired the property in 2021 and has invested capital improvement dollars into upgrading and repositioning the asset. Under previous ownership, a freestanding restaurant building was constructed for Velvet Taco on the property’s surface parking lot in 2020. The restaurant chain’s new office space will be located on the building’s second floor. Founded in 2011, Velvet Taco has restaurant locations in Dallas, Fort Worth, Houston, Austin, Atlanta, Chicago and Charlotte.

The Commons (Source: CoStar)

Dallas-based global tax services firm Ryan LLC has broken ground on its 23-story, 409,000 square foot, Class "AA" office tower (8101 Windrose Avenue) in Plano’s $3 billion Legacy West mixed-use project. Ryan Tower is being constructed on a 3.6-acre site at a $120 million price tag near the southwest corner of the Dallas North Tollway and State Highway 121. Ryan will relocate more than 500 employees from its current office at the Galleria Towers in Dallas into seven floors (floors 9-11 and 20-23) totaling 200,000 square feet. Ryan is projecting a 3rd quarter 2024 delivery date for the building. The selection of Legacy West as the site of Ryan's new headquarters was "a purposeful part of our team member-centric strategy to be the best workplace in tax globally," said Brint Ryan, chairman and CEO of Ryan LLC. The tax firm's new headquarters will be at the center of where its employees live, complementing its long-held hybrid work strategy of offering "the best opportunity for work-life success." Ryan has had a hybrid work policy since prior to the pandemic as a recruitment tool in hiring sought-after professionals. Ryan is developing the office tower in a joint venture with Koch Real Estate Investments, which is the real estate investment arm of Koch Industries. The project is designed by Dallas-based architect Gensler and is being constructed by Minneapolis-based developer Ryan Cos. (no affiliation with Ryan LLC). Ryan originally purchased a 6-acre tract, providing area for a future, second high-rise office tower.

Rendering of Ryan's new Legacy West office tower (Source: The Dallas Morning News)

Adjacent to Ryan Tower will be an 18-story, high-rise apartment tower, which received approval for a zoning change by the Plano City Council at its June 13 meeting. Columbus Realty, one of the three companies that originally developed Legacy West, is proposing the new residential project. The residential tower will feature 177 units and be constructed on a 2-acre tract at the corner of State Highway 121 and Windrose Avenue.

Dallas-based real estate investment firm Dalfen Industrial, which is one of the nation’s largest industrial developers and a leader in the last-mile property sector, has announced a three-building, 600,000 square foot speculative warehouse project that will start construction this summer in north Frisco just south of U.S. Highway 380 along Rockhill Parkway near the new PGA of America headquarters. The industrial project will cost $40 million or $67 per square foot. Developers have been ramping up industrial development in Frisco as demand for distribution space has exploded. Jerry Jones’ Blue Star Land just filed plans for a new industrial building in his 200-acre Star Business Park on Preston Road in north Frisco. Dallas’ Crow Holdings recently purchased a 100-acre site in the $10 billion Fields development with plans to develop an industrial business park. In December, Dalfen committed $430 million for industrial properties in multiple markets and closed on $2.4 billion in acquisitions and developments in 2021.

Plano-based blockchain infrastructure company InfStones is nearing “unicorn status” after a $66 million investment funding round led by Japanese behemoth SoftBank and California venture capital firm GGV Capital, which is backed by the likes of Airbnb, Peloton and Alibaba. InfStones’ new funding brings its total capital raised to over $100 million. The term “unicorn status” is given to startups that have reached the coveted valuation exceeding $1 billion. The list of unicorn companies is just over 1,100 worldwide and includes Irving-based precision medicine company Caris Life Sciences and Dallas-based software firms 09 Solutions, ISN, LTK and Island. InfStones, which was founded in 2018, will use the cash injection to fund its expansion and accelerate growth, including hiring employees and making acquisitions. The company currently employs 40 workers globally across offices in Plano, Palo Alto, Montreal and Beijing and was headquartered in Palo Alto until last year when the company relocated its headquarters to Plano. “Over the past couple of years, we had hired a lot of new talent in Texas, the central U.S. and eastern U.S. We learned that Texas is a more friendly space for the company,” remarked business development director Sili Zhao. InfStones was founded by Zhenwu Shi, who earned a doctorate in electrical and computer engineering from the Georgia Institute of Technology in 2014 and worked as a software engineer at Oracle and a platform engineer at C3 AI before launching InfStones. InfStones helps clients build applications on blockchain networks, including Etherium, Cardano, Polygon, Solana and Chainlink. Investors have been pouring money into the blockchain space. Venture capital funding for crypto companies surged to $27 billion globally last year, more than the past 10 years combined.

InfStones founder Zhenwu Shi (Source: The Dallas Morning News)

After five years of development plans and city meetings, Firefly Park is officially moving forward after Frisco City Council amended a zoning ordinance at its June 21 meeting that would allow the 230-acre, mixed-use project at the southwest corner of U.S. Highway 380 and the Dallas North Tollway. Wilks Development, which is based in the small west Texas town of Cisco, is partnering with The BFC Group, UNStudio and Sasaki on the project. The development plans call for 2,200 residential units, 4,750,000 square feet of office space, 380,000 square feet of retail space, hotel, music hall, outdoor amphitheater and 30 acres of park space. The residential units will comprise a mix of townhomes and mid- and high-rise apartments. Phase one of the development will consist of a 200-room boutique hotel operated by New York-based Dream Hotel Group, office space and green space. Dream Hotel, which is scheduled to break ground in 2023 and open its doors in 2026, will anchor the development.

Rendering of Firefly Park (Source: D Magazine)

Dallas-based Crow Holdings has filed plans and taken a $64 million building permit for the development of a 7-story, 235,000 square foot office building at the northeast corner of State Highway 121 and Spring Creek Parkway in Frisco. The speculatively-built office building will be part of a 60-acre, $850 million mixed-use development called Southstone Yards, which was originally planned to include four office towers totaling 1.4 million square feet of space, a full-service hotel, 80,000 square feet of retail space, 1,000 apartments and townhouses and a series of parks and open space. North Carolina apartment builder LMC, a division of Lennar Corporation, has also filed plans to build a 5-story, 355-unit rental community within the project.

Rendering of Southstone Yards office tower (Source: CoStar)

Missouri-based private real estate investment firm Larson Capital Management has acquired 5445 Legacy Drive (Legacy Center) in the Legacy market from Dallas-based developer Cawley Partners. The $58,000,000 purchase price equates to $331 per square foot and includes $43,610,000 in financing from BrightSpire Capital. The 4-story, 174,975 square foot Class “A” office building, which was constructed in 2015 at the northwest corner of Legacy Drive and Hedgcoxe Road, was 96% leased at the time of sale and anchored by Wipro Technologies (43,750 SF) and Main Event Entertainment (28,547 SF). Larson expects to hold the asset for a 5 to 7 year period. Larson also recently went under contract at $62,500,000 or $280 per square foot to purchase the office building next door to Legacy Center at 5465 Legacy Drive (The Plaza at Legacy), which is currently 81% leased and has been owned by New York-based MetLife since 2014. MetLife reportedly purchased the building in 2014 for $58,000,000 or $260 per square foot. Larson is projected to close on The Plaza at Legacy on July 22, 2022.

Legacy Center at 5445 Legacy Drive (Source: CoStar)

Plano-based developer Heady Investments has broken ground on The Railhead, an 80-acre, $2.5 billion mixed-use project north of Main Street along the west side of the Dallas North Tollway in Frisco. Development plans call for 1 million square feet of offices space, 1,280 apartments, high-rise residential buildings, multiple hotels and a centrally-located 5-acre park. The project’s location, being situated between the new PGA of America headquarters and resort and the Dallas Cowboys’ Star development, was a big factor in the development. Heady is partnering with longtime landowner Jim Newman and apartment builder JPI on The Railhead. The first phase of the project will be a 450-unit apartment community that will include 17,000 square feet of ground-floor retail space, which will begin construction after the master developers complete infrastructure with roads and utilities on the property between the Dallas North Tollway and Legacy Drive. Newman’s family originally arrived in Frisco in 1841 and the Frisco railroad line came through the town in 1902, which changed everything. The Railhead has sites for up to five, high-rise office towers and hotels on the east side of the property along the Dallas North Tollway. The apartment communities will face the park and be situated on the west side of the development. Other sites can accommodate a combination of retail and office uses. Financing for the project is being provided by Simmons Bank.

Rendering of The Railhead (Source: The Dallas Morning News)

1. Sako and Partners Lower Holdings dba Asset Living

Building: 15601 Dallas Parkway / Addison Circle One

Type: New Lease

Size: 9,642 SF

Term: 29 months

Free Rent: 1 month

Start Rate: $25.00/NNN

Bumps: $0.50/SF

TI: "As Is"

2. American Neighborhood Mortgage Acceptance Company

Building: 6509 Windcrest Drive / Tollway North Office Park

Type: New Lease

Size: 5,779 SF

Term: 32 months

Free Rent: 2 months

Start Rate: $14.00/NNN

Bumps: $0.50/SF

TI: "As Is"

________________________________________________

I specialize in representing office tenants in the North Dallas/Plano/Frisco market. Please let me know if I can be of service with your real estate needs (relocation search, expansion, lease renewal negotiations, building/condo purchase, sublease, portfolio management).

Learn why Cresa only represents tenants/occupiers exclusively.

Tor Erickson | Senior Vice President

Cresa

One Cowboys Way, Suite 350

Frisco, TX 75034

469.323.5395

terickson@cresa.com

cresa.com/dallas