Please find May's edition of my monthly update on the North Dallas-Plano-Frisco office market detailing the latest office tenant and building news as well as lease transactions recently signed.

If you have an office decision to make, please contact me for help with your real estate needs.

Market News

The occupancy rate in DFW office buildings rose to 51.8% in April 2022, which represents the second-highest rate since the pandemic chased workers en masse out of their offices into a remote-work environment. Only Austin (62.4%) and Houston (56.3%) have higher occupancy rates nationwide among the top business cities tracked by Kastle Systems, which has measured weekday keycard access to buildings it secures since the start of the COVID-19 pandemic. In Kastle’s 10 largest metropolitan areas, which include New York City, Los Angeles, Chicago and San Francisco, the most recent weekly average occupancy was 42.8% with San Jose, California, ranking last at 31.8%.

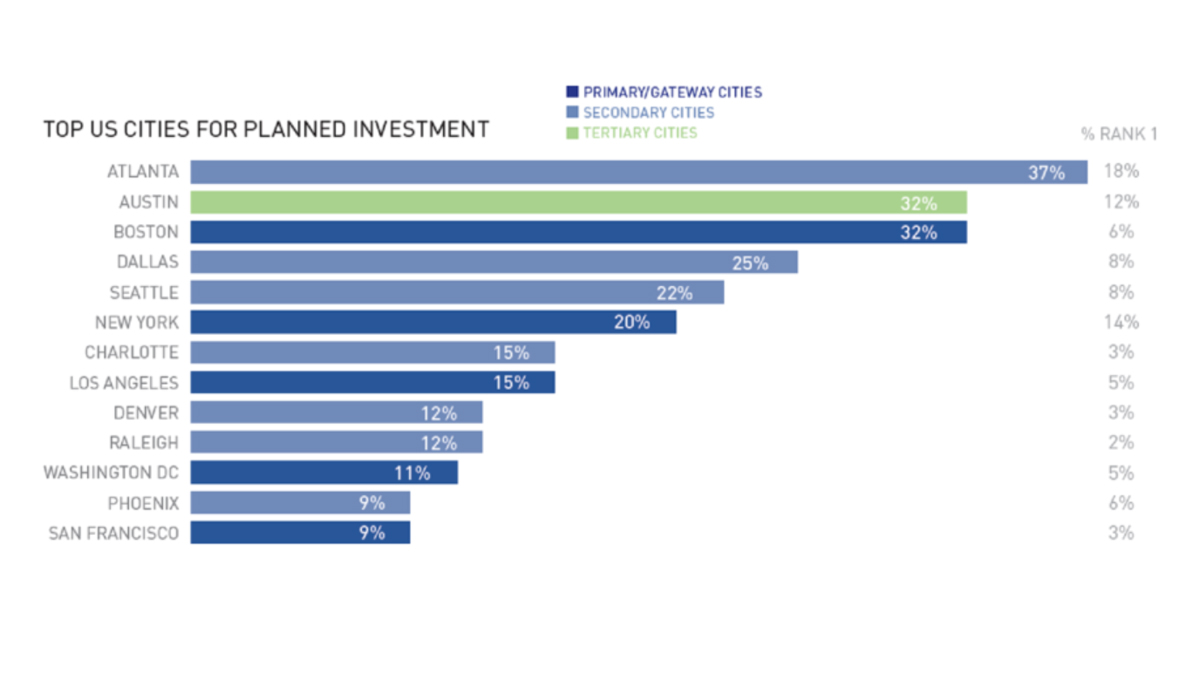

An annual investor survey conducted by the Association for Foreign Investment in Real Estate (AFIRE) on its 175 real estate organizations in 23 countries shows that global investors remain keen on the U.S. commercial real estate market. Three in four investors plan to increase their volume of activity this year and eight in ten investors expect to increase their U.S. exposure over the next three to five years. In a sign of changing strategies, the survey shows that tier-one markets like New York City and Los Angeles no longer consistently top institutional investors’ lists. Secondary and tertiary cities have risen to the highest point on investors’ radar. Atlanta, a secondary city, was the top U.S. choice among respondents, with 37% selecting the city. The tertiary market of Austin was selected by 32%, tying primary market Boston for the number two spot, while Dallas ranked fourth on the list at 25%. The traditional top markets of New York City (20%), Los Angeles (15%) and San Francisco (9%) have become less attractive year-over-year due to a host of factors, including rising crime, an increasingly burdensome regulatory climate, higher cost of living, pandemic responses and lower yields.

AFIRE 2022 Top U.S. Cities for Planned Investment (Source: Commercial Property Executive)

New-York based Teachers Insurance and Annuity Association (TIAA), one of the world’s largest pension funds and financial advisors, will be moving 2,000 jobs to Jerry Jones’ The Star development in Frisco. TIAA has executed a lease agreement to occupy the entire 15-story, 525,000 square foot to-be-constructed Class “AA” office tower, which will be located in the northwest quadrant of the Dallas North Tollway and Cowboys Way. In the deal, TIAA and its real estate division Nuveen Real Estate will co-develop and manage the property. TIAA will commit $58 million in finishing out and furnishing the new office space while also receiving an $18 million grant from the Texas Enterprise Fund to help pay for the Frisco office. The new office is scheduled to open when the building is delivered in 2024 and will be fully staffed by 2029. The Fortune 100 firm currently has $1.4 trillion in assets under management and pays billions in annual benefits to its clients, which are primarily retired educators. TIAA currently has an office in Lewisville, which will relocate to The Star upon opening and will be staffed with a range of client relations, service and technology roles.

The Star (Source: Dallas Morning News)

Pittsburgh-based PNC is opening its fourth U.S. tech hub in Farmers Branch, another sign that the company plans to invest in the North Texas region following its merger with Houston-based BBVA in 2021. PNC acquired BBVA for $11.6 billion, a move that “pulled our growth forward in Texas and in North Texas by at least five years,” according to PNC’s North Texas regional president Brendan McGuire. PNC gained 2.6 million BBVA customers with the merger. PNC’s workforce totals 59,426 employees across the U.S., with DFW quickly becoming a top-five market for the company. The Farmers Branch tech hub will house 200 mostly tech workers. The bank, which has $550 billion in total assets, spends over $2 billion annually on technology. PNC currently has 118 bank branches in the DFW area, with 13 of those branches serving as their “bank branch of the future,” which put a focus on technology while having bankers available to help customers get information and make decisions.

PNC North Texas Regional President Brendan McGuire (Source: Dallas Morning News)

Dallas-based Remington Hotels, a management firm tied to hotelier Monty Bennett’s Ashford Inc. holdings, is expanding its footprint in the Midwest with a $26 million acquisition of Chesapeake Hospitality. Chesapeake Hospitality will join the Dallas-based management arm under Bennett’s umbrella of hospitality companies. Bennett is the Chairman and CEO of family-founded Ashford Inc., which serves as an adviser to publicly-traded real estate investment trusts Braemar Hotels and Resorts Inc. and Ashford Hospitality Trust, both of which are owned by Bennett. The combined companies currently occupy approximately 80,000 square feet of space at 14185 Dallas Parkway (Centura Tower), which is located at the southwest corner of the Dallas North Tollway and Spring Valley Road. Remington will gain properties in a few new Midwest markets, including Pittsburgh, Milwaukee, Detroit and St. Louis. The company will have a portfolio of 121 managed properties under contract in 28 states and Washington, D.C., following the closing of the cash and stock deal. Chesapeake’s 1,370 field employees and 19 of its 30 corporate staff will move into roles with Remington.

In 2021, Chesapeake earned $200 million in annual revenue while Remington earned over $1 billion in annual revenue with 6,000 employees. With its acquisition of Chesapeake Hospitality, Remington Hotels has grown the percentage of hotels in its portfolio that are not owned by Ashford Inc.’s related companies from 20% to 40% and the two companies also benefit from having no overlap of ownership groups. The company is now the fifth-largest hotel operator, behind Plano-based Aimbridge Hospitality, Highgate, Benchmark Pyramid and Crescent Hotels & Resorts. Terms of the deal were $6.3 million in cash and $9.45 million in preferred Ashford Inc. stock upfront with the possibility of adding another $10.25 million over the next two years depending on the performance of the legacy Chesapeake portfolio. Assuming the Chesapeake portfolio performs well enough for earn the incentives, the deal will represent a 4.9-times earnings multiple for Ashford.

Centura Tower (Source: CoStar)

Dallas-based Capstar Real Estate Advisors and Chicago-based Blue Vista have brought The Belvedere (14881 Quorum Drive) out to market for sale. The 9-story, 141,180 square foot Class “B” office building, which was constructed in 1984 just west of the Dallas North Tollway and south of Belt Line Road along the west side of Quorum Drive, is currently 74.4% leased and is anchored by Aperia (31,112 SF), TForce Logistics (16,392 SF) and Mayse & Associates (8,855 SF). Capstar and Blue Vista acquired the building in 2015 for $13.1 million or $93/SF. The initial offer due date has not been set yet.

14881 Quorum Drive (Source: CoStar)

Plano-based LandPlan Development has broken ground on its 4-story, 57,168 square foot medical office building situated in the southeast quadrant of Parkwood Boulevard and SH-121. The developer is currently offering units for sale at $350 per square foot for shell condition space or for lease at $30.00/NNN. The minimum square footage required to lease or purchase is 3,000 square feet and the property is already 50% leased/sold.

Parkwood Heights (Source: CoStar)

Iowa-based real estate investment firm Rehman Enterprises has brought 1518 Legacy Drive out to market for sale. The 2-story, 27,125 square foot office building, which is located at the northeast corner of Legacy Drive and Town and Country Boulevard, just north of State Highway 121, is currently 100% leased and is anchored by Veritex Community Bank (5,163 SF), State Farm Insurance (1,950 SF) and McQuaid Vein Care and Surgery (1,500 SF). Rehman Enterprises acquired the building in 2016 from McQuaid Vein Care and Surgery and is currently marketing the property at a purchase price of $8,120,000 on a 6.00% capitalization rate based on an NOI of $487,011.

1518 Legacy Drive (Source: CoStar)

Billingsley Co.’s International Business Park (“IBP”), situated at the intersection of the Dallas North Tollway and Plano Parkway, is less than twelve months away from completion of IBP’s newest building – 6275 W. Plano Parkway. The 5-story, 252,000 square foot Class “A” building will feature the first parking garage within the IBP development, which currently comprises ten office buildings, and will include 50,400 square foot floorplates, 15-foot slab-to-slab glass views, balconies on the 4th and 5th floors, 5.0/1,000 SF parking, park with paved trails and outdoor seating areas, and an adjacent amenity center building. Billingsley is currently quoting $28.00/NNN ($8.50/SF) + Electric ($1.00/SF) for space and is willing to break up a floor for a 10,000 square foot user. For more information, see the property brochure.

6275 W. Plano Parkway (Source: CoStar)

Missouri-based Larson Financial Group has purchased 5810 Tennyson Parkway (Lincoln Legacy Two) in the Legacy market. The 5-story, 130,371 square foot Class “A” office building, which was constructed in 2014 in the southeast quadrant of Tennyson Parkway and the Dallas North Tollway, is currently 97.2% leased and is anchored by LiquidAgents Healthcare (28,099 SF), White Rock Oil & Gas (26,943 SF), Next After (9,744 SF) and Goldman Sachs Personal Financial Management (6,147 SF). Larson acquired the building from Dallas-based Pillar Commercial, which had held the asset since 2018 after paying $39,111,300 or $300/SF.

5810 Tennyson Parkway (Source: CoStar)

San Francisco-based Spear Street Capital has brought The Campus at Legacy (5340 and 5360 Legacy Drive) out to market for sale. The two-building offering (the entire campus represents three buildings with the third building being separately owned) comprises 3-story, 359,570 (5340 Legacy) and 358,839 (5360 Legacy) square foot Class “A” office buildings, both of which were originally constructed in 1986 as part of Ross Perot’s EDS headquarters campus. The combined assets are currently 78.9% (5340 Legacy) and 61.3% (5360 Legacy) leased and are anchored by North American Coal Corporation (38,258 SF), National Benefit Services (33,094 SF), Stack Sports (31,197 SF), ArcBest Technologies (23,372 SF) and Optimal Blue (17,438 SF). Spear Street acquired the campus in 2016 from KDC.

The Campus at Legacy (Source: CoStar)

Plano’s Planning and Zoning Commission has approved a proposed 177-unit, 18-story apartment tower on one of the last remaining undeveloped tracts of land at Legacy West. Columbus Realty, one of the three companies that co-developed Legacy West, is proposing the new residential high-rise tower. The project would sit on a 2-acre site at the southeast corner of State Highway 121 and Windrose Avenue. The development plan will now go before Plano City Council for final approval.

Plano’s 1.4 million square foot The Shops at Willow Bend has been acquired by Dallas-based real estate investment firm Centennial in partnership with Dallas-based office developer Cawley Partners and New York-based Waterfall Asset Management. The partnership’s immediate plan is to complete construction of the center’s movie theater, which was abandoned during the pandemic, and will consider developing an office building that had been proposed under the previous ownership. Willow Bend had been controlled by lenders since 2020 after former owner Starwood Retail could not refinance a $137.5 million loan that came due in 2019.

Dallas-based tax services firm Ryan LLC, the world’s largest firm dedicated to business taxes with more than 3,000 employees in 60 countries and 18,000 clients, is set to start site work on its 24-story, 426,000 square foot office tower located near the southwest corner of the Dallas North Tollway and State Highway 121 in Plano’s $3 billion Legacy West development. The office tower will cost $120 million and is expected to be completed by May 2024. Ryan LLC plans to owner-occupy 200,000 square feet on floors 1 through 11. The remaining 226,000 square feet on floors 12 through 19 will be available for lease. The Class “AA” office tower is being designed to include a fitness center, multiple conference centers, tenant lounge and café as well as outdoor amenities such as green space and bike storage. Ryan LLC, which purchased the 6-acre tract just north of Liberty Mutual Insurance’s campus in 2017, will have room on the site to develop a second office tower in the future. Under the conditions of an economic incentives agreement that contributed to the firm’s relocation to Plano, Ryan LLC will qualify for $467,500 in economic incentives so long as the company moves its corporate headquarters and at least 550 full-time employees from its current headquarters in Dallas’ Galleria Towers by March 31, 2023. While construction on the new tower will not be completed until one year after that deadline, I would expect the Plano City Council to consider a revision to Ryan’s agreement. Many North Texas cities have extended such agreements, taking into consideration the extraordinary impact the pandemic has had on office development plans.

Ryan LLC at Legacy West (Dallas Morning News)

Lease Transaction Comps

1. Northwest Hardwoods

Building: 2600 Network Boulevard / Hall Park

Type: New Lease, Size: 23,000 SF

Term: 129 months

Free Rent: 9 months

Start Rate: $24.75/NNN

Bumps: $0.75/SF

TI: $50.00/SF

2. Titan Rock Investor

Building: 2701 Dallas Parkway / Parkway Centre IV

Type: New Lease

Size: 4,211 SF

Term: 65 months

Free Rent: 5 months

Start Rate: $17.25/NNN

Bumps: $0.50/SF

TI: $23.00/SF

3. Proterra Advertising

Building: 16415 Addison Road / Addison Tower

Type: New Lease

Size: 3,943 SF

Term: 36 months

Free Rent: 0 months

Start Rate: $22.50/Full Service

Bumps: $0.50/SF

TI: $5.00/SF

________________________________________________

I specialize in representing office tenants in the North Dallas/Plano/Frisco market. Please let me know if I can be of service with your real estate needs (relocation search, expansion, lease renewal negotiations, building/condo purchase, sublease, portfolio management).

Learn why Cresa only represents tenants/occupiers exclusively.

Tor Erickson | Senior Vice President

Cresa

5005 Lyndon B. Johnson Freeway, Suite 800

Dallas, TX 75244

469.323.5395

terickson@cresa.com

cresa.com/dallas