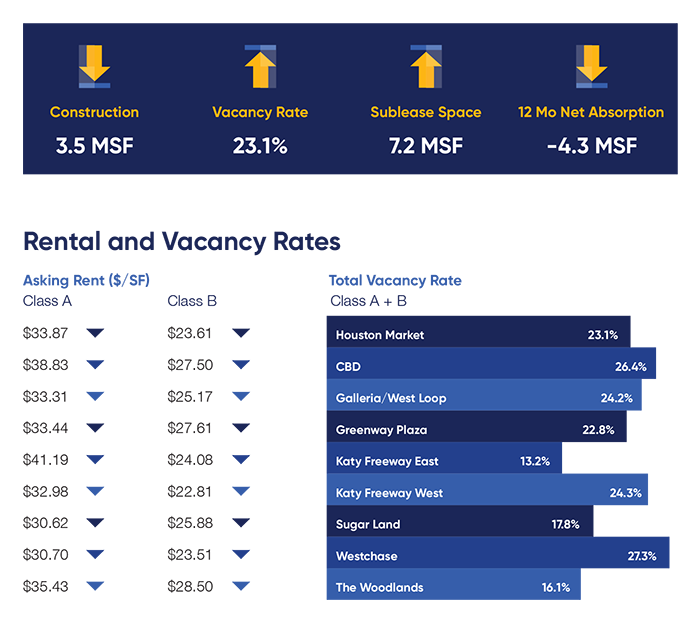

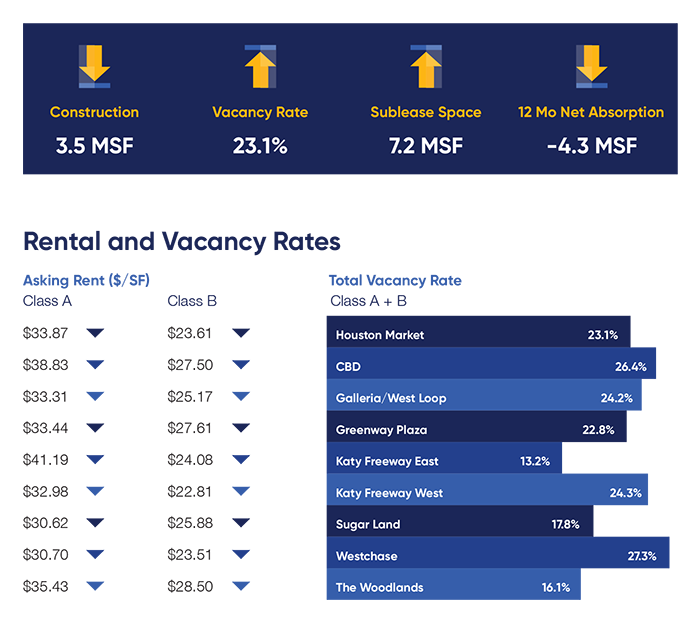

With the vaccine rollout ongoing and oil prices continuing to inch upward, there are signs the economy is beginning to ramp back up following months of sluggishness spurred by the pandemic. Yet the Houston office market has yet to see demand return as the leasing market remains stalled. Total vacancy is again on the rise topping in at 23.1%, the highest rate in the country among major metros. Leasing activity remained flat as only 4.3 MSF was taken down year to date, less than half the total over the same period a year ago. Available sublease space has continues to rise, tallying an increase of nearly 600,000 SF from Q1 2021 for a total of 7.2 MSF available. At the height of the oil slump in 2016, sublease space accounted for 4.5% of inventory, 50% higher than the current 2.9%. With a full recovery still months or possibly years away, landlords will be pressed to become even more aggressive offering competitive rates and generous concession packages in what was already a very occupier friendly market.