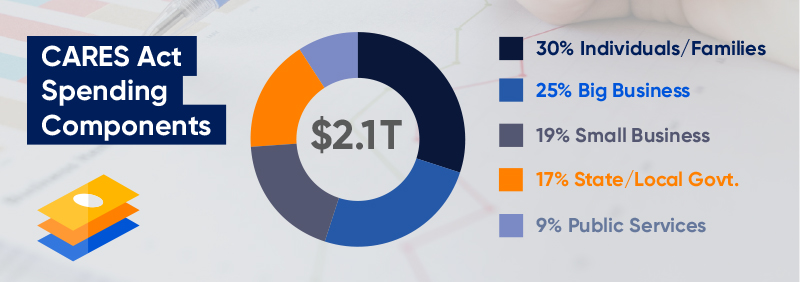

The recently passed $2.1 trillion CARES Act, combined with additional private credit facilities, will assist businesses in keeping up with essential operating costs attempting to put the economy back on track to its prior levels of strength. Here’s a breakdown of the funding options for big and small businesses:

$350 Billion for Small Businesses through U.S. Small Business Administration (SBA)

-

Expedited loans with flexible terms up to $350,000 allow small businesses to pay operating expenses and retain employees.

-

Larger standard loans up to $5,000,0000 are available for working capital, expansion and renovation and new construction, once activity resumes.

-

Loans for small retail and hospitality put the emphasis on retaining employees to help stabilize the labor market. If used as intended the loans may be forgiven.

$500 Billion for Large Corporations

-

Loans and investments to stabilize industries impacted particularly hard by the pandemic.

-

The airline industry will have access to $58 billion for employee wages, salaries and benefits as well as passenger and cargo carriers and airline contractors.

-

Industrial support is provided to ensure that supply chains can be ramped up once activity resumes with minimal disruptions.

-

Fully refundable tax credits for businesses that have closed or are distressed due to the pandemic are available to be used to keep employees on payroll.

Additional Funding

-

An additional $4 trillion of liquidity will be available via new credit facilities.

-

Enhanced unemployment insurance and direct payments to consumers making $100,000 or less annually, allow for continued consumer spending. The intent is for the spending to move through the economy.