Please find August's edition of my monthly update on the North Dallas-Plano-Frisco office market detailing the latest office tenant and building news as well as lease transactions recently signed.

If you have an office decision to make, please contact me for help with your real estate needs.

Metro, State and National Office Market News

In the first half of 2022, DFW topped Los Angeles, Atlanta and Houston on the list of the nation’s largest commercial property markets by sales volume. The DFW market produced $22.9 billion in combined sales of office, industrial, retail and multi-family product followed by Los Angeles at $15.5 billion in sales. This is the third straight year for DFW to top the list at the mid-year point. DFW’s total volume of $22.9 billion smashed the market’s prior record by 54%. Nationwide, $375.8 billion in commercial real estate investment was recorded, up 38% from the first six months of 2021.

According to CommercialEdge data, DFW’s office market sales totaled 3.3 million square feet in May 2022, reflecting a 65% increase month-over-month and more than 300% higher than May 2021 when 922,540 square feet exchanged hands in DFW. DFW’s office transaction level, as of May 2022, was $1.8 billion year-to-date at an average sale price of $180 per square feet, which was 10% lower month-over-month. The vast majority of office sales in 2022 have occurred in suburban submarkets.

Delinquency on commercial mortgage-backed securities (CMBS) loans for office buildings nationwide remained fairly steady during Q2 2022, but rising interest rates could spell trouble for maturing loans. There are billions of dollars’ worth of CMBS loans due to mature in the next 18 months. Approximately $33.2 billion will come due across 9 U.S. metro areas before the end of 2023. Manhattan holds the lion’s share of debt coming due ($15.6 billion) followed by Chicago ($4.2 billion), Los Angeles ($3.8 billion) and Washington, D.C. ($3.0 billion). Older office buildings are struggling to sign new leases as remote work and a flight to quality have caused vacancy to spike to near-record highs and created obstacles for owners looking for new debt. Office loans slated to mature within the next three years could face high debt service coverage ratios. Some owners may seek to hand the keys over to lenders or sell off office properties at a loss. Investors in 34 distressed properties across the nation lost a cumulative $263 million in May 2022 alone.

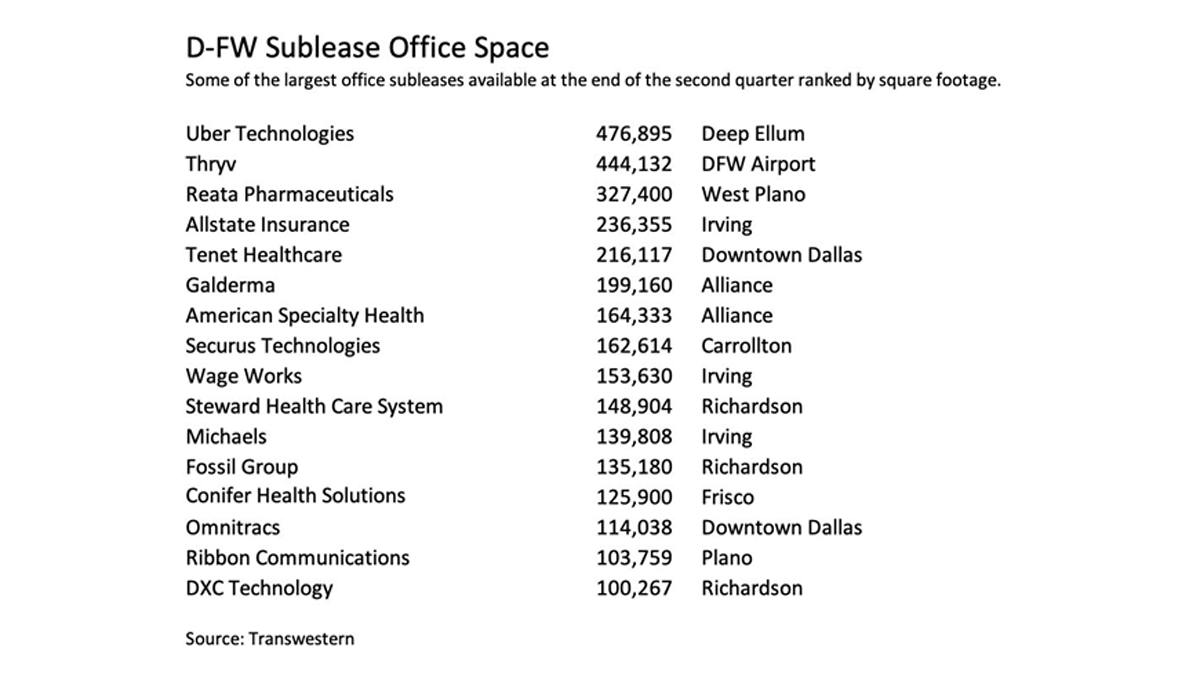

DFW office leasing has rebounded from the COVID-19 pandemic, but the recent uptick in office demand has not yet put a dent in the huge supply of surplus sublease space on the market. As of the end of the 2nd Quarter 2022, companies were marketing 10 million square feet of sublease space in the DFW market. It appears unlikely that sublease space makes significant headway as remote work is prolonging the recovery of sublease inventory. The supply of sublease inventory is actually greater than the 7.1 million square feet of office space currently under construction in the DFW market. Below is a list of the largest office sublease spaces currently on the market in the DFW area.

Fortune 20 energy giant Chevron, the second largest U.S. energy producer and marketer, has announced plans to sell its global headquarters in San Ramon, California, and shift some of its workforce to downtown Houston. California will remain Chevron’s corporate home, even as the company reduces its 1.4 million square foot headquarters expense and right sizes its office space needs for its headquarters-based employee population. The current headquarters comprises a 92-acre campus that includes 13 buildings and capacity for 2,000 employees. As part of the downsizing and relocation, Chevron has offered to cover moving expenses for employees who decide to relocate to its Houston campus, where the company has 6,000 employees and is the result of years’ worth of gradually shifting the bulk of its California workforce to Texas. Chevron expects to move out of its San Ramon campus by 2023.

Chevron's Global HQ in San Ramon, CA (Source: CoStar)

Irving-based Seven & I Holdings Co., the world’s largest convenience store retailer and parent company of 7-Eleven, has announced 880 corporate jobs will be cut at the chain’s Irving headquarters as well as in Ohio in a restructuring process tied to its $21 billion acquisition in 2020 of Speedway’s 3,800 stores in the U.S. and Canada from Marathon Petroleum Corporation. Soon after the deal closed, 7-Eleven sold 293 retail gas stations across 20 states after regulators said the deal violated antitrust laws. The Japan-based parent company of 7-Eleven operates 9,000 stores in the U.S., making it the largest convenience store chain in the nation. Gas demand, which accounts for a large part of 7-Eleven’s business, is projected to slow as high prices and supply chain disruptions further affect the industry.

7-Eleven Headquarters at Cypress Waters (Source: CoStar)

The Irving City Council approved an economic incentives package totaling $31 million in exchange for San Francisco-based Wells Fargo, the nation’s third largest bank, to build a $200 million regional office campus for 4,000 employees. The package includes a $19 million grant paid using tax increment financing funds and a $12 million grant with some minimum requirements. Minimum requirements for Wells Fargo to access the economic incentives include the purchase of 22 acres of land near Las Colinas Boulevard and Promenade Parkway by the end of the year as well as investing $200 million into the property by 2027. The land acquisition will make way for the development of two, 10-story, 400,000 square foot office towers, which will be constructed by the end of 2026. Dallas-based development firm KDC will handle the development of the project.

Wells Fargo's Regional Campus Site in Irving's Las Colinas Urban Center (Source: CoStar)

Far North Dallas Office Submarket News

Frisco-based private real estate investor Noel Yi has brought 17440 Dallas Parkway out to market for sale after acquiring the property in December 2019. The 2-story, 53,784 square foot Class “B” office building, which was constructed in 1982 along the east side of the Dallas North Tollway and south of Trinity Mills Road, is 87% leased to a diversified mix of 43 tenants. The average in-place rents are $15.75/SF plus electricity versus an asking rent of $17.00/SF plus electricity. The post-pandemic, return-to-office phase has helped drive the property’s occupancy from 53% in Q1 2021 to its current level of 87%. Approximately 43% of the rent roll expires within the next 12 months, creating opportunity for a buyer to push rents to market quickly.

Duke Bridges III (7460 Warren Parkway), a 3-story, 161,131 square foot Class “A” office building at the intersection of Warren Parkway and the Dallas North Tollway, is offering top-of-building signage for a 38,449 square foot vacancy on the 3rd floor after Oracle announced they will vacate the 3rd floor when their lease agreement expires in February 2023. The property features a 4.5 per 1,000 SF parking ratio, on-site security and is quoting $32.00/SF + Electric.

Duke Bridges III at 7460 Warren Parkway (Source: CoStar)

California-based real estate lender Acore Capital is providing $125 million in debt financing for Dallas-based tax services firm Ryan’s 23-story office tower under construction in Legacy West near the southwest corner of State Highway 121 and the Dallas North Tollway. Ryan plans to relocate its headquarters from the Galleria Tower in Dallas to Ryan Tower at Legacy West when the project is completed in the 3rd Quarter 2024. Ryan will relocate more than 500 employees from its current office into seven floors (floors 9-11 and 20-23) totaling 200,000 square feet. The remaining 200,000 square feet is being marketed for lease. Acore Capital’s confidence in making this construction loan is attributed to excellent sponsorship from Ryan and 50% pre-leasing of the asset. Acore Capital has almost $18 billion in assets under management.

Rendering of Ryan Tower (Source: Dallas Morning News)

The U.S. Southern District court in New York is giving Atlanta-based developer Wade Park Land LLC another shot at proving they were defrauded by their lender, Gamma Real Estate Capital. Wade Park Land LLC, developer of the proposed $2 billion Wade Park mixed-use development at the southeast corner of the Dallas North Tollway and Lebanon Road, sued Gamma Real Estate Capital following the lender taking ownership of the property in 2019 after a loan default. The developer filed for bankruptcy and accused the lender of fraud and wrongly taking back the property. The lawsuit asked for hundreds of millions of dollars in damages from Gamma Real Estate and its executives. In March, a New York federal court dismissed all claims against the lender. But now, the same court has given the Wade Park developer another opportunity to argue in favor of some of their claims. The judge has said the developer can replead two of their fraud claims. Construction on the massive 175-acre Wade Park project was halted in 2017, leaving behind half-finished buildings and a huge hole in the ground. Gamma Real Estate investors have been working with the city of Frisco to come up with alternative development plans for the high-profile site.

Plano-based national rent-to-own giant Rent-A-Center,which occupies 98,649 square feet at 5501 Headquarters Drive, has agreed to pay $15.5 million to settle a lawsuit that alleged the company engaged in unlawful business practices, including overcharging customers and failing to inform them of their rights. The lawsuit was filed by the California attorney general. As part of the settlement, Rent-A-Center would pay $13.5 million in restitution to thousands of customers and $2 million in civil penalties. For the quarter ended June 30, the retailer posted lower profits of $19 million or 33 cents per share versus a profit of $61.3 million or 90 cents per share for the prior year. Total revenue declined by 10% over the past 12 months from $1.19 billion to $1.07 billion.

Dallas-based real estate investment firm KOA Partners has broken ground on Trinity Mills Station, a 25-acre, 3-phase mixed-use development at the southeast corner of State Highway 190 and Interstate Highway 35E in Carrollton. Phase I of the development will include a 6-story, 125,000 square foot Class “A” office building that will deliver in the 1st Quarter 2024 along with 10,000 square feet of retail space. The building will feature a rooftop patio, tenant lounge, conference room, fitness center and 4.0/1,000 SF parking. The city of Carrollton has agreed to master lease the entire building, which has allowed the developer to move forward with construction on a speculative basis. Future development will include hotel, multi-family, retail and entertainment uses surrounding a park. The site provides for a true transit-oriented development due to the presence of the DART Green Line and DCTA Train Line that run adjacent to the property. Phases two and three of the project are entitled for 250,000 and 500,000 square foot office buildings. Ownership is currently marketing space at $34.00-$36.00/NNN ($10.25/SF). Private investor Noel Yi has purchased 8131 LBJ Freeway, which comprises an 8-story, 227,891 square foot office tower in the northwest quadrant of LBJ Freeway and North Central Expressway in Dallas, from Arlington-based SkyWalker Property Partners. SkyWalker acquired the building in February 2019 from Credit Union of Texas and invested $1.3 million into upgrading the property. The building was 61% leased at the time of the sale. Yi acquired the property using funds from a 1031 tax exchange.

Trinity Mills Station (Source: KOA Partners)

San Diego-based real estate investment firm Tourmaline Capital, which acquired The Apex at Legacy (5801 Headquarters Drive) from Plano-based Heady Investments in June 2021, will be completing its initial construction of the building amenities in September, which includes a social hub featuring lounge spaces, fireplace and grab n’ go food service, integrated outdoor terrace with shade structure and built-in kitchen, game lounge with golf simulator, multi-room conference and training center and fitness center with tech-enabled equipment. The 13-story, 206,420 square foot office tower is a podium-style structure whereby the parking garage takes up the first six floors followed by seven floors of office space (28,345 SF floorplates) with direct elevator access from the parking garage to tenant spaces. Tourmaline Capital is currently marketing space at $36.00/NNN ($15.03/SF).

The Apex at Legacy at 5801 Headquarters Drive (Source: CoStar)

Plano-based First Guaranty Mortgage Corporation has laid off the majority of its staff and filed for bankruptcy. The mortgage lender terminated 428 of its 565 employees who work for its Plano office. The company said the layoffs were caused by “significant operating losses and cash flow challenges due to unforeseen historical adverse market conditions for the mortgage lending industry, including unanticipated market volatility.” The company was founded in 1987, acquired Charlotte-based Goodmortgage.com in 2016 and relocated its headquarters to Plano in 2019. Investment management firm PIMCO acquired a large stake in the mortgage lender in 2015. The bankruptcy filing allows the company to borrow funds to continue operations while in bankruptcy proceedings. It is not yet known whether the company plans to sell or reorganize in some other way. Former employees have filed a class-action lawsuit against the company in the U.S. Bankruptcy Court, claiming the lender did not give them the 60-day layoff notice required under the federal Worker Adjustment and Retraining Notification Act and are asking for the 60 days of back pay and benefits required when not giving the notice.

Dallas-based real estate developer Crow Holdings is beginning construction on the first mass timber office building in the DFW area in Frisco. The Offices at Southstone Yards, which is located at the northeast corner of State Highway 121 and Spring Creek Parkway, will comprise a four-building office park totaling 1.1 million square feet of office space at full build out. In addition to the office park, the 45-acre mixed-use development is being designed with 9 acres of green space, retail, restaurants, hotel and 1,000 apartments and townhouses. Phase one of the office project will consist of a 7-story, 235,000 square foot mass timber office building. The development will also include two parks over three acres, on-site fitness and wellness centers, conference facilities and executive meeting areas. The office building is scheduled to be completed by the 3rd Quarter 2023 and is expected to cost $60 million. The city of Frisco granted the developers economic incentives that could total as much as $10 million over the next 8 years to support the project. Developers have increasingly turned to wood projects in recent years, with timber being a lower-carbon alternative to more commonly used building materials such as steel and concrete, while still offering structural integrity and resistance to fires. Mass timber construction also results in higher thermal insulation and greater design flexibility. This building will include raised floors, which will offer more flexibility for its electrical infrastructure and result in reduced build-out costs and is expected to be easier to maintain over the long haul. Mass timber projects, which can be built quicker and with fewer workers, are underway or have been recently completed in Atlanta, Baltimore, Cleveland, Houston, Portland and Washington, D.C.

The Offices at Southstone Yards (Source: CoStar)

Centra Frisco Realty, an affiliate of Frisco-based Bhagmati Holdings, has purchased a 40-acre development site at the southeast corner of the Dallas North Tollway and U.S. Highway 380 and is in the planning phase for a mixed-use project. The high-profile corner is near the site of the new PGA headquarters and golf course development and Omni Resort. The site was sold by a partnership that includes Dallas businessmen Ray Washburne and Stephen Summers, owners of the landmark Highland Park Village, and investor David Fogel. The partnership had owned the land since 2018. Development activity along U.S. Highway 380 has soared with expansion of the highway and the development of nearby residential communities. The Dallas North Tollway bridge over U.S. Highway 380 is nearing completion, which will make this intersection development ready after years of anticipation.

Rendering of Centra Frisco Realty's 40-Acre Project (Source: Dallas Morning News)

San Antonio-based Frost Bank, which is making a massive push to open banking centers in Collin County, is underway with construction for an 11,250 square foot financial center at the southwest corner of the Dallas North Tollway and Warren Parkway adjacent to Hall Park. The branch is one of 28 new locations for Frost Bank in the DFW metroplex with plans to open three new locations in Frisco.

The Dallas Independent School District (DISD) has acquired The Crossings II at 5501 Lyndon B. Johnson Freeway just east of the Dallas Galleria from Irving-based Thompson Realty. Constructed in 1980, the 12-story, 296,587 square foot office tower was recently renovated and is currently 100% leased. Thompson Realty had owned the asset since 2004. This is the second large purchase from the school district in recent years after acquiring 9400 North Central Expressway in 2016 when the district relocated its headquarters from downtown Dallas. Heading into the new school year, the DISD has been attempting to lure teachers from the Austin area with $3,000 sign-on bonuses and even launched a billboard campaign across central Texas, Arizona and Arkansas.

The Crossings II at 5501 LBJ Freeway (Source: CoStar)

North Dallas-based Ashford Hospitality Trust (Centura Tower at 14185 Dallas Parkway) is selling two hotels by the end of the year as the company works to deleverage its balance sheet. Both hotels are non-core properties in its portfolio of 100 hotels and 22,313 rooms. The sale of the two hotels is expected to generate $15 to $20 million in proceeds that will be used to pay down debt and deleverage the company’s balance sheet. Ashford had funds from operations of $44.6 million in the 2nd Quarter 2022 and reported a loss of $9.3 million for the quarter. This comes as the REIT chipped away at hotels in so-called cash traps under their loans, meaning any excess cash flow generated by the hotels would be held by the lender and not available for corporate purposes. At the end of fiscal year 2021, Ashford reported 93% of their hotels were in cash traps. That number improved in the 2nd quarter 2022 by moving down to 85% in cash traps. As of June 30, the company had $3.9 billion in loans with a blended average interest rate of 5.6%. The hotelier’s properties continue to see performance climb. During the 2nd quarter, occupancy increased 28% compared with the same period last year with the average daily rate also increasing by 34% year over year.

Dallas-based developer KDC has completed the second phase of McKinney-based Independent Financial’ s $150 million headquarters project at State Highway 121 and Alma Drive. The addition of the 6-story, 198,000 square foot office building more than doubles the banking firm’s footprint within McKinney Corporate Center in Craig Ranch. The initial 159,000 square foot building was completed in 2019.

Independent Financial Headquarters (Source: KDC)

Lease Transaction Comps

1. Sako and Partners Lower Holdings dba Asset Living

Building: 15601 Dallas Parkway / Addison Circle One

Type: New Lease

Size: 9,642 SF

Term: 29 months

Free Rent: 1 month

Start Rate: $25.00/NNN

Bumps: $0.50/SF

TI: "As Is"

2. American Neighborhood Mortgage Acceptance Company

Building: 6509 Windcrest Drive / Tollway North Office Park

Type: New Lease, Size: 5,779 SF

Term: 32 months

Free Rent: 2 months

Start Rate: $14.00/NNN

Bumps: $0.50/SF

TI: "As Is

I specialize in representing office tenants in the North Dallas/Plano/Frisco market. Please let me know if I can be of service with your real estate needs (relocation search, expansion, lease renewal negotiations, building/condo purchase, sublease, portfolio management).

Learn why Cresa only represents tenants/occupiers exclusively.

Tor Erickson | Senior Vice President

Cresa

One Cowboys Way, Suite 350

Frisco, TX 75034

469.323.5395

terickson@cresa.com

cresa.com/dallas