The CRE Sentiment Index is an effort to understand the change in perspectives of corporate real estate professionals on the state of the industry and the impact on their company’s real estate portfolios and alignment with the direction of the business. This effort has been an ongoing campaign in partnership with Knight Frank, our global partner.

The index is forward looking with the questions asking what do expect in the next six months and is segmented into three categories: 1) Growth Dynamic; 2) Portfolio Dynamic; and 3) Workplace Dynamic.

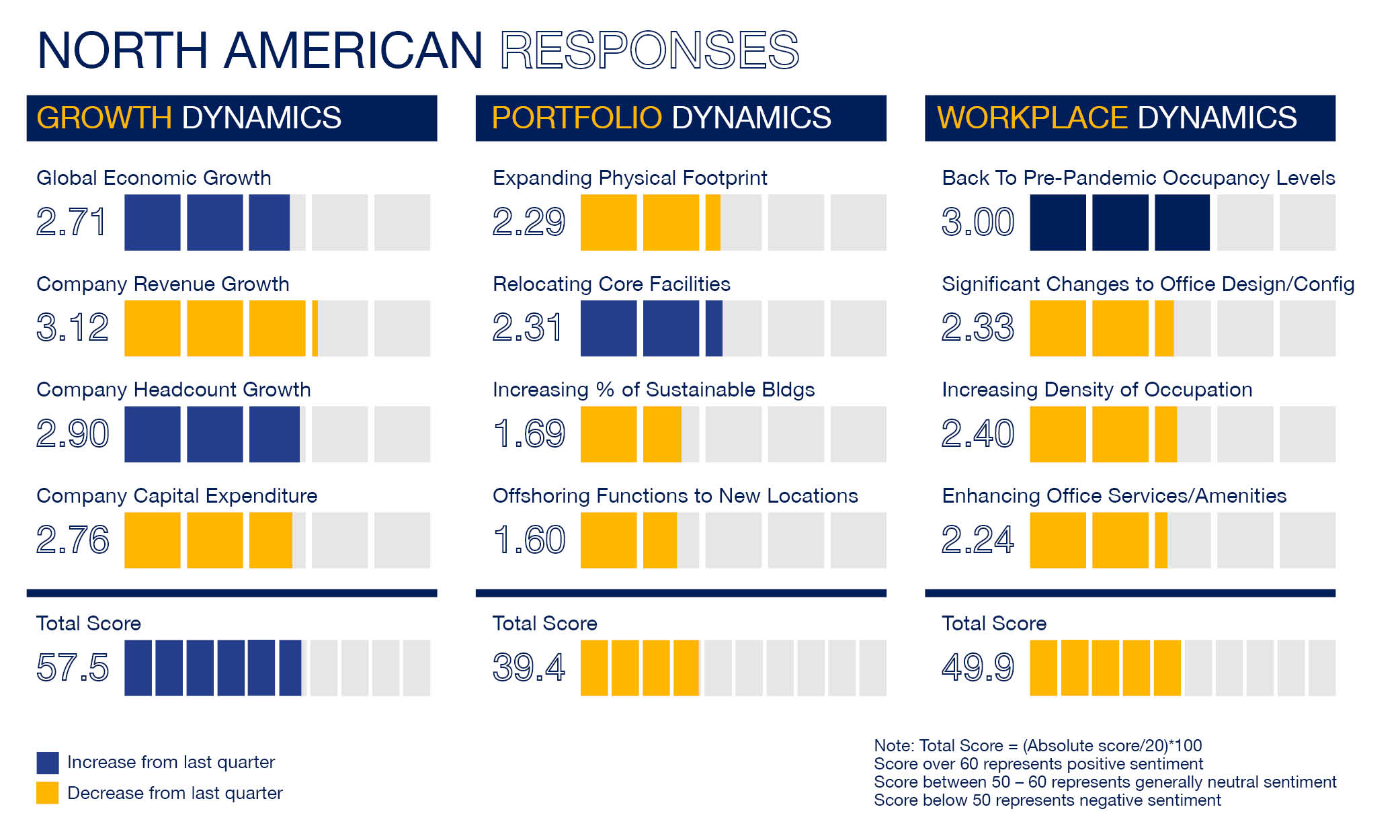

For each of the sub-indexes, the following scores reflect the CRE Sentiment over the next six months.

- A score over 60 represents positive sentiment.

- A score between 50 – 60 represents generally neutral sentiment.

- A score below 50 represents negative sentiment.

The CRE Sentiment Index for the first quarter of 2024 was 48.9. This total score was slightly lower than the prior survey that was completed six months ago, which was 49.2. The index score fell into a negative sentiment, indicating that CRE professionals believe the next six months will likely be more reactionary and cautionary as organizations reconcile economic headwinds along with identifying effective and efficient use of space and their overall portfolios. The next CRE Sentiment Index will be conducted after the third quarter of 2024.

The Growth Dynamic (overall score 57.50) provides insight into the sentiment for the overall health of the business and planned change in global economic growth, revenue, headcount, and capital expenditures. The respondents were generally neutral to positive in this category, with a neutral outlook for company headcount growth over the next six months.

The Portfolio Dynamic (overall score 39.40) asks questions related to the expected change in CRE portfolios, including physical footprint, relocation, sustainability, and offshoring. Respondents were generally negative in this category, particularly about offshoring and sustainability efforts.

The Workplace Dynamic (overall score 49.88) explores respondents forward-looking sentiment to occupancy levels, office design, occupancy density, and amenities. Respondents were generally neutral to slightly negative about the workplace, indicating pessimistic sentiment in the next six months surrounding changing office design and enhancing office services/amenities. Since the last survey, there has been increased optimism relating to offices returning to pre-pandemic occupancy levels.

The Growth Dynamic sub-index skewed more optimistic compared to the prior survey, led by a more favorable view on global economic growth and company headcount growth. The score grew to 57.5, but still did not cross over into positive territory (above 60). The Growth Dynamic sub-index was the highest (most optimistic) of the three sub-indexes.

The Portfolio Dynamic sub-index is the most pessimistic of the three sub-indexes, falling below a total score of 40. Responses to the questions for the Portfolio Dynamics sub-indexes were generally downbeat, with three of the four responses dropping from the previous survey. However, the question asking about relocating core facilities increased slightly, but remains a negative sentiment. Meanwhile, companies are not focusing on increasing the percentage of sustainable buildings in their portfolios, or offshoring functions to new locations. Generally, the Portfolio Dynamic sub-index indicates that companies are cautious about making changes to their portfolio in the short-term.

The Workplace Dynamic sub-index shifted downward slightly, but moved into the negative sentiment territory, settling at 49.88. While companies were less optimistic about making significant changes to office design and enhancing office services/amenities, more companies are feeling more favorable about returning to pre-pandemic occupancy levels.

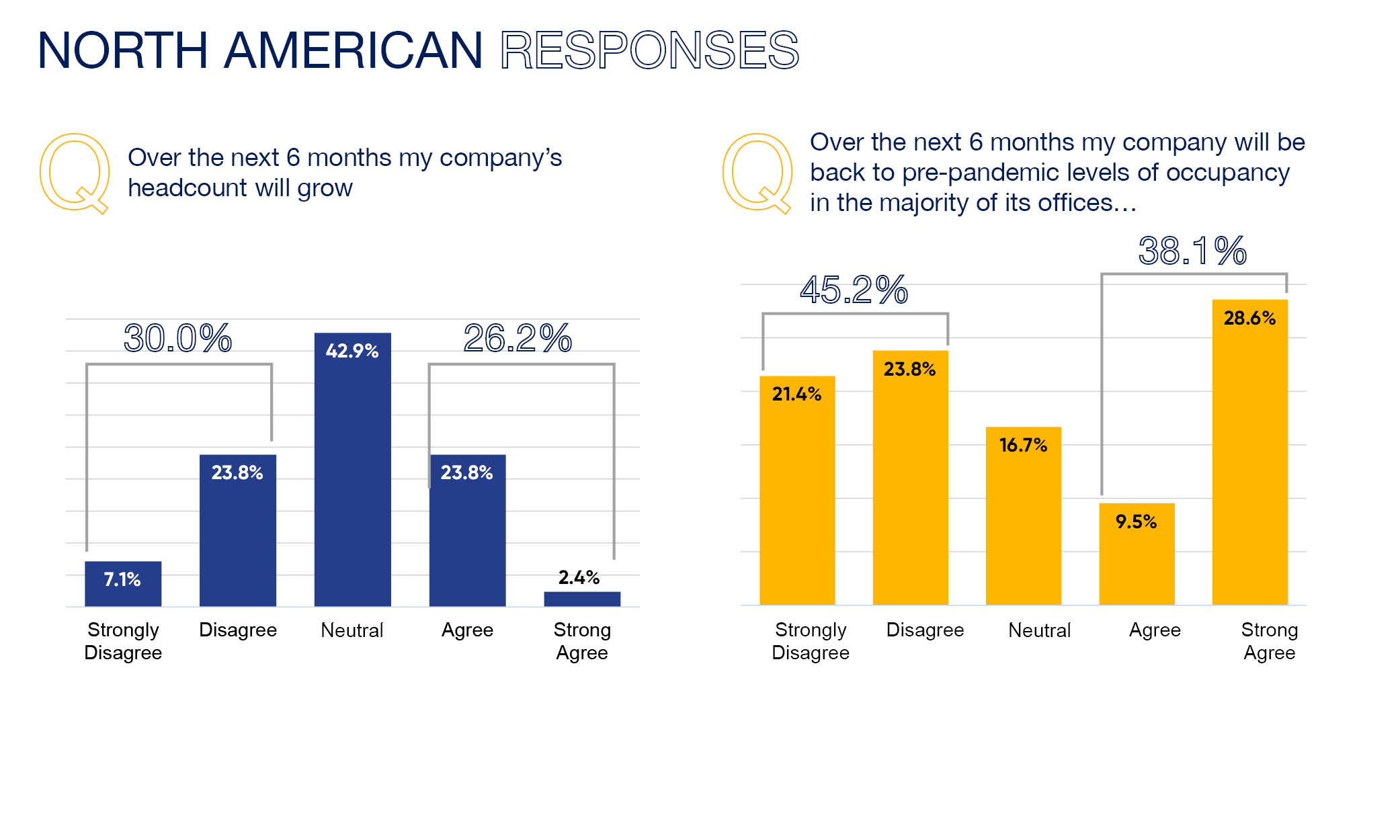

North American respondents were divided about whether their company would be growing their headcount in the in the next six months.

The number of North American respondents that believe their company will be back to pre-pandemic occupancy levels in the next six months has grown from the previous survey. Further, more than 28 percent of respondents believe occupancy will be back to pre-pandemic levels in the next six months, compared to only 12.1 percent strongly believing this during the Q3 2023 survey.

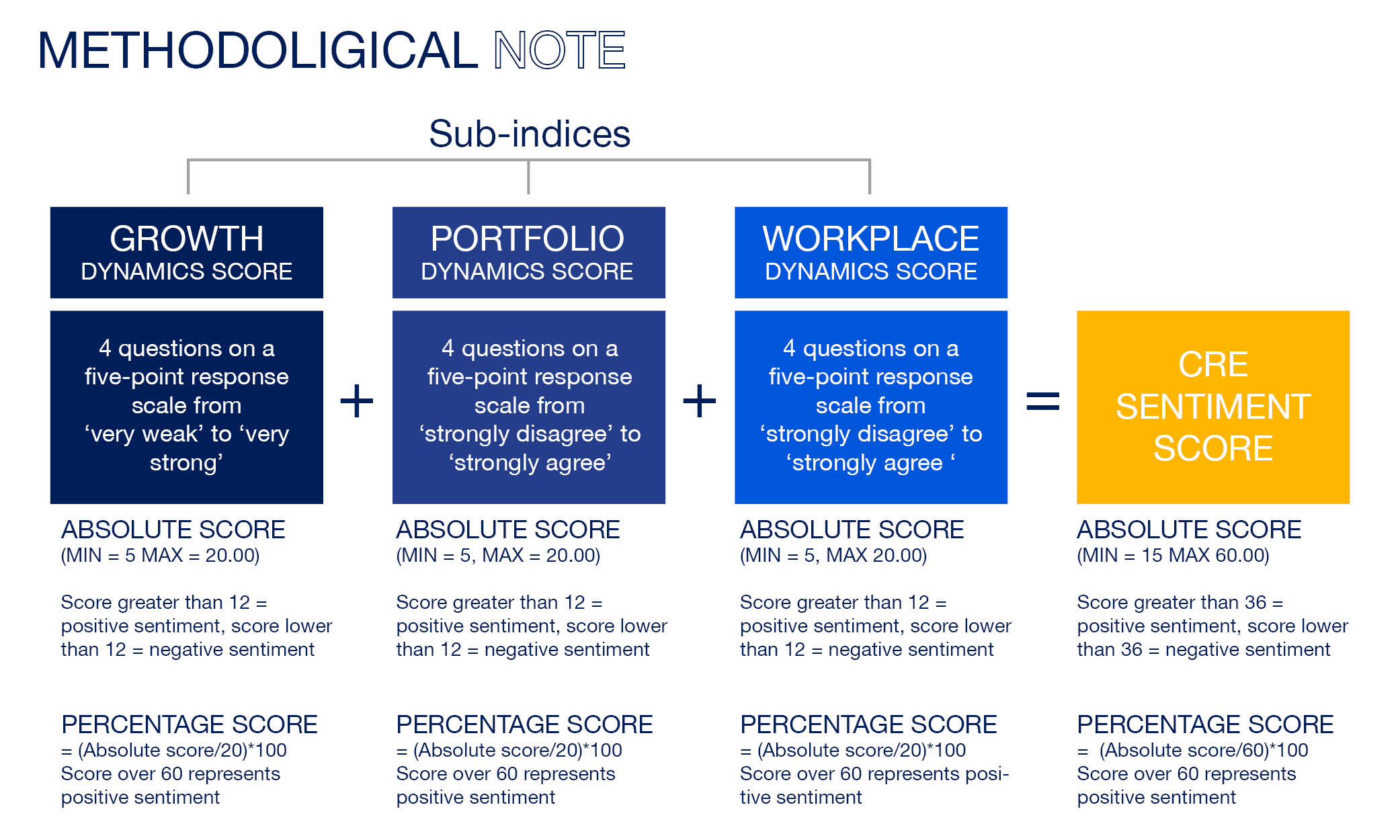

METHODOLOGY

A simple on-line survey of 12 questions grouped into three equally weighted sub-indices assessing growth dynamics, portfolio dynamics and workplace dynamics.

Each sub-index comprises of four statements which survey respondents place on a five-point response scale, with a score of one indicating strong negative sentiment and a score of five indicating strong positive sentiment. A score of three represents neutral sentiment.

The survey is based on sentiment relating to the next six months from the point of survey.

Responses to each of the four statements at the sub-index level are aggregated across the sample and averaged. These averages are then added together to provide a sub-index sentiment measure, to a maximum absolute score of 20. A score greater than 12 indicates positive sentiment, less than 12 represents negative sentiment. Each cohort sentiment measure is also converted to a percentage score, with a score above 60% representing positive sentiment.

Each of the three sub-index sentiment measures are then added together to provide an overall absolute CRE Sentiment Score, to a maximum of 60 and where a score greater than 36 indicates positive sentiment. Again, this overall score is also converted into a percentage value, with a score above 60% representing positive sentiment.

For a more in-depth analysis and a broader perspective, we invite you to download the full Q1 Sentiment Index here. The report delves into global trends and provides valuable insights that can help inform your decision-making processes.