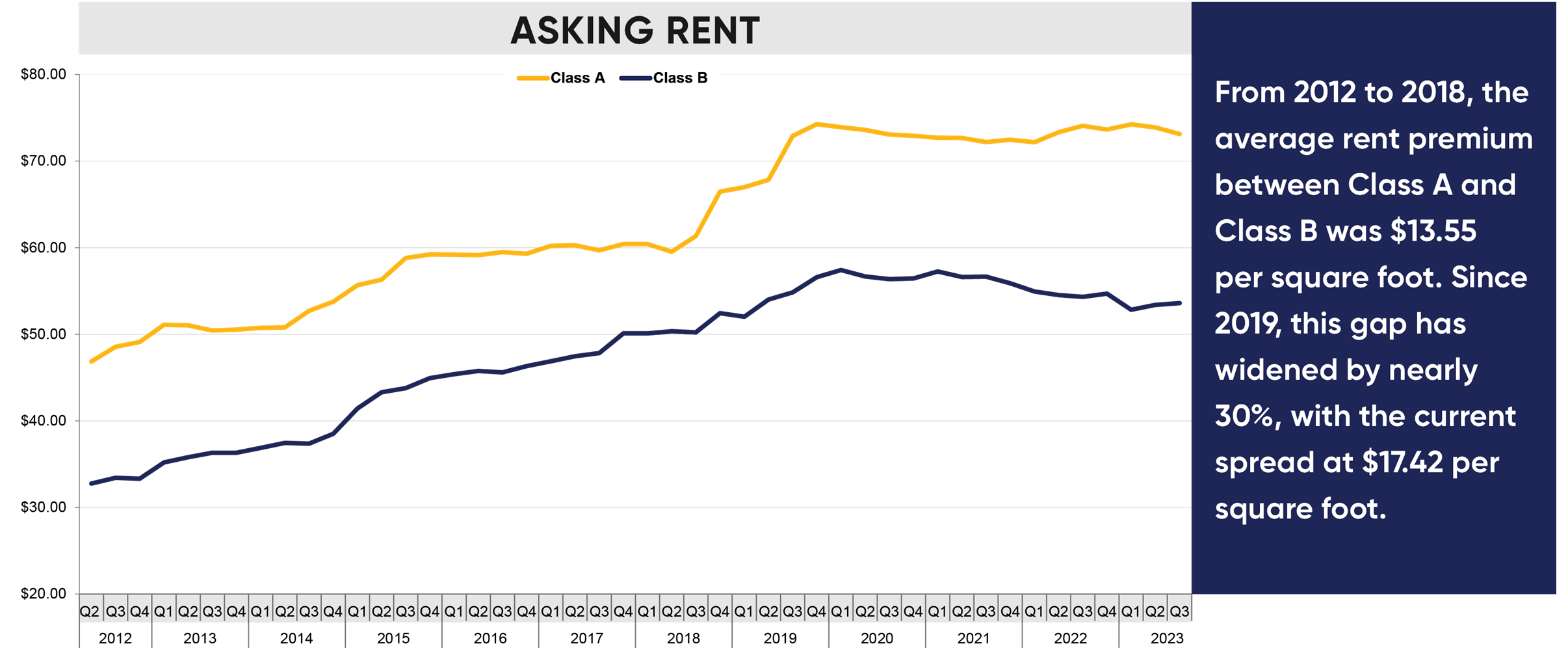

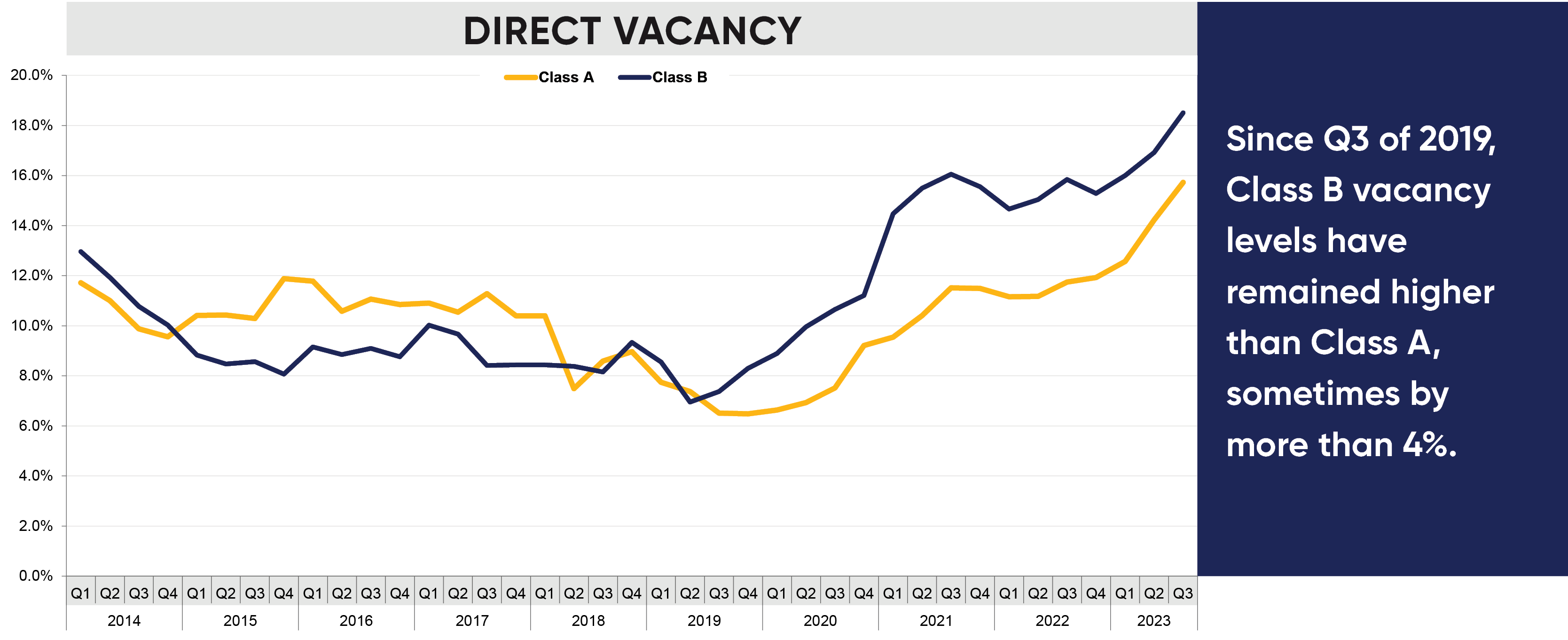

Greater Boston’s commercial real estate market has seen a remarkable flight to quality in recent years, fueled by widespread preference for Class A spaces that will encourage employees back into office throughout the week. Across industries, the majority of tenants in the market are looking for smaller, top-quality workplaces that offer high-end amenities and require minimal modifications. This shift in demand has exacerbated the gap between Class A and Class B spaces in a number of ways. In the graphs below, our proprietary market data illustrates the widening discrepancy between space types.

While vacancy in Class B spaces was lower than Class A in the years leading up to the pandemic, 2019 saw that trend reverse. With both space types now struggling with limited demand, Class A spaces seem to have the edge for the foreseeable future, as occupiers continue to prioritize quality in the in-office experience.

What Does It Mean?

The trends in both rent rates and vacancy levels provoke questions around the purpose and future of commercial real estate. Is in-office work a drag on hiring efforts and the bottom line? Or does the investment in the workplace pay off with accelerated innovation and collaboration? Companies in Class A spaces have invested heavily in real estate, and in doubling down on their commitments have identified space as core to the success of their businesses. Others have taken the opposite approach, determining that space is not critical – or even detrimental – to their business function.

Which of these philosophies will perform well in the long-term? Is it more beneficial to a company’s bottom line and employee retention efforts to adopt a fully remote model, or to lease a Class B office space? What will follow cubicles and open floor plans as the next office space craze, and how will it affect the market? As organizations navigate the rises and falls of an uncertain economy, these questions and others remain top of mind. Landlords, tenants, and advisors alike are closely monitoring the data to see the answers take shape.