While the calendar flips into 2021, it is hard not to feel like time has come to a halt as the impacts of the global pandemic have brought the economy to a standstill. Coupled with the ongoing uncertainty in the energy sector that had yet to recover from the last downturn, Houston’s office leasing market has stalled.

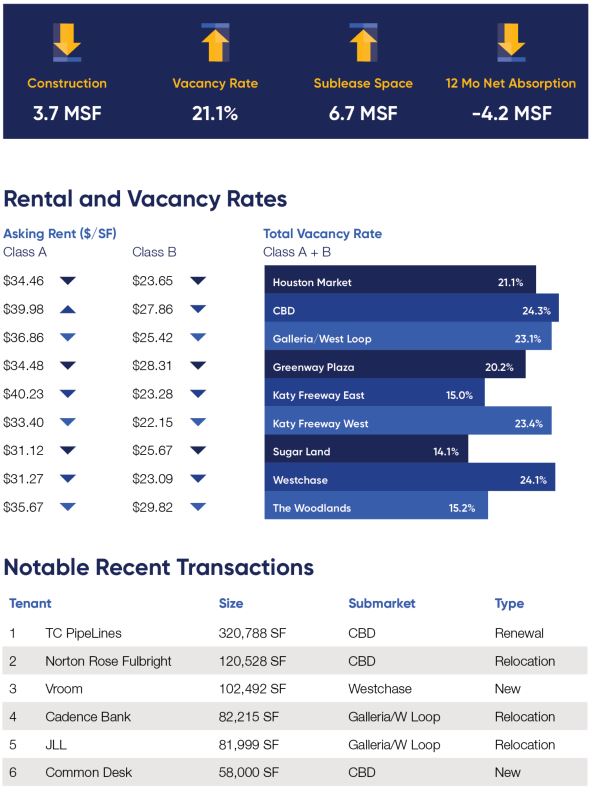

Total vacancy is again on the rise, topping in at 21.1% as the city has posted a negative net absorption of over 4.2 MSF in 2020. Leasing activity contracted by more than 5 MSF year-over-year as demand continued to dry up. Available sublease space has begun to jump, tallying an increase of nearly 750,000 SF for a total of 6.7 MSF available. At the height of the oil slump in 2016, sublease space accounted for 4.5% of inventory, roughly double the current 2.7%.

With a recovery still months or possibly years away, landlords will be pressed to become even more aggressive offering competitive rates and generous concession packages in what was already a very occupier friendly market.

Download the full report for more information.