As companies across the globe begin to plan and implement a Return to Office (RTO) program, many are left wondering what our work life will look like going forward. There is a widely shared belief that things will be different, but we are far from a consensus on which lasting impacts will shape how and where we work.

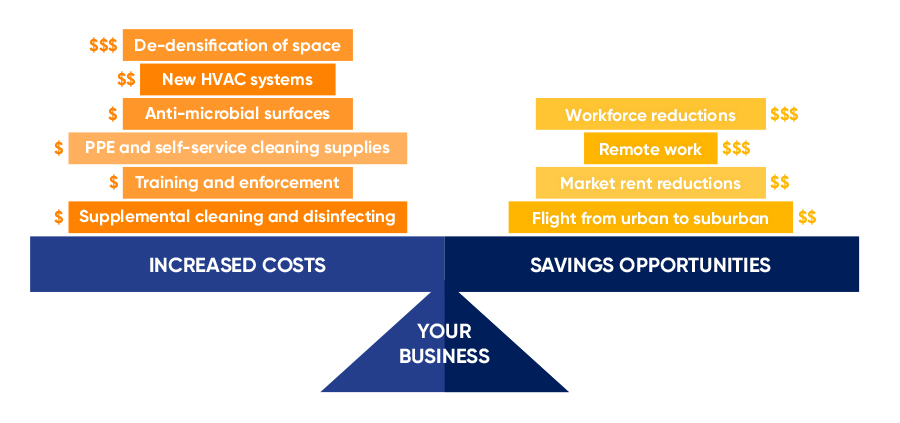

Social distancing and personal protective equipment (PPE), not even in our vernacular just four months ago, may change space requirements and possibly even building codes in the months ahead. Remote work has sky-rocketed and most RTO programs will include a mix of options encompassing remote work, shift work and increased physical distance between occupied workspaces.

As new programs are tested and rolled out, employers will be faced with an office portfolio that is misaligned with their actual demand for space. At the same time, booming real estate markets across the country are now anticipated to experience a downturn with vacancy rates climbing while rental rates and valuations decline. Once immediate operational and human resources needs are met, employers will need to pivot to rationalize their long-term real estate costs.

While the changes around us are significant, many of the new demands facing real estate professionals are a continuation of trends that first took root 20 and 30 years ago. If we employ the tried and tested discipline of portfolio optimization, we will be well prepared and capable of delivering safe, productive and financially viable workplaces.