As a tenant in the market considering renewal or looking for new space, there are questions that should be asked and due diligence that needs to be completed to ensure that you are protected in this environment. The following is an overview of the financing concerns and a checklist for occupiers of space to consider while making decisions for the future of your organization.

Recent news of federal bailouts of several banks has opened fresh wounds from the 2008 financial crisis. Regional and smaller banks are the largest lenders, approximately 30%, on commercial properties. The CMBS market iseffectively shut down and life insurance lenders are highly selective in their underwriting criterion.

The lending market has slowed down especially so for office space. Adding fuel to this tenuous situation is the drop in demand for office space as employees have not returned to the office en masse.

As building owners are faced with rising interest rates, lenders are dealing with falling loan to value ratios from their borrowers. Trepp has reported that $270 billion in commercial real estate loans held by banks will come due in 2023, roughly 33% of which are office properties. Challenging refinancing scenarios will put building owners in a difficult position,including giving buildings back to lenders or searching for alternative ways to refinance debt.

The financial health of your landlord should be a crucial factor in decision making.

Owners Hit by Tighter Financing with Higher Interest Rates

If a property falls back to the lender, the result may be for the lender to sell the property at a steep discount. Borrowers looking to refinance are facing loan to value ratios that don’t pencil out on thelending side, due in part to rising interest rates. Occupiers may be faced with landlord instability andunpaid allowances which could lead to the risk of inferior building services.

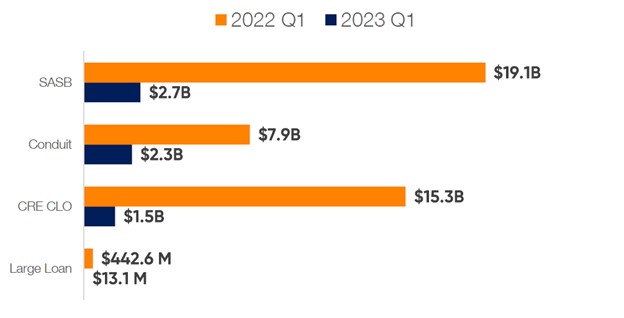

Issuance of CMBS Down Over 80% from Last Year

Source: Trepp SASB Single Asset Single Borrower; Conduit: commercial real estate first mortgage debt, which is pooled together and held in a trust; CRE CLO: commercial real estate collateralized loan obligation

Fast Facts:

- Defaults on commercial real estate loans surged to a 14-year high (5.2% in February)

- Almost $1.5 trillion of US commercial real estate debt comes due for repayment before the end of 2025.

- Office properties accounted for about 14% of all defaulted CMBS debt transferred in February to special servicers to work out payments.

- Small and regional banks have more exposure to commercial real estate debt (30% of total lending) than larger more diversified banks (16 percent of total lending)

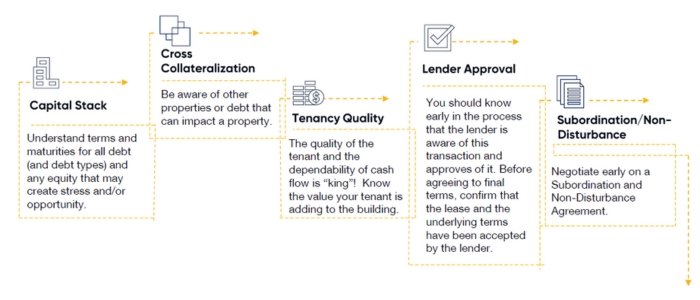

Be in The Know: A Checklist

The Value of a Tenant

- Extending a term or expanding a lease can provide the landlord with the enhanced ability to refinance.

- A distressed building may be rescued by a tenant, resulting in better market terms for the tenant – lower rents, increased abatements and/or allowances.

- If market conditions continue to deteriorate, landlords will offer better terms to survive.

Real estate decisions are typically one of the three biggest expenditures for a business. Not only is leasing space costly, but also it is inflexible with longterm commitments. As a result, real estate decisions are a strategic investment for any organization. Therefore, it is important for tenants to ensure they are protected and understand their options should the building that they are occupying come under financial duress.

Reach out to a member of Cresa's Capital Strategies Team for more information.