A Lease Expense Review is a financially beneficial process to ensure compliance with the costs set out in your lease, and where appropriate, recover historical overcharges by your landlord, while also preventing these overcharging from recurring in the future. The best time, and how often to do a lease expense review varies. However, if you have never done a Lease Expense Review, then, put simply, the right time is now; otherwise, you may be leaving your money on the table.

From errors in accounting software to changes in “cosmetic” capital improvements, discrepancies are bound to occur. It is then up to you, the occupier, to uphold the conditions of your lease to guarantee your continued success.

To ensure consistent compliance with certainty, we recommend that clients undergo a desktop review annually. We realize, however, that the feasibility of such a process varies from client to client. Keeping this in mind, we have discerned the three ideal stages to consider:

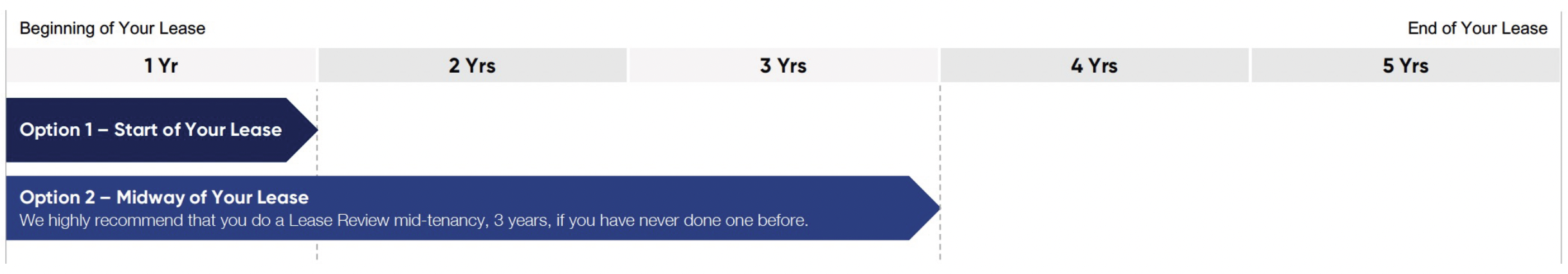

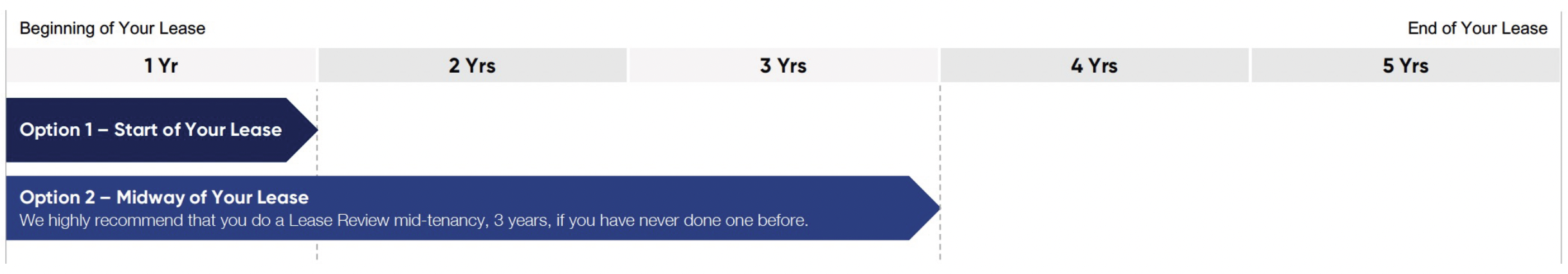

Scenario 1: if you, the tenant, have a 5-year lease:

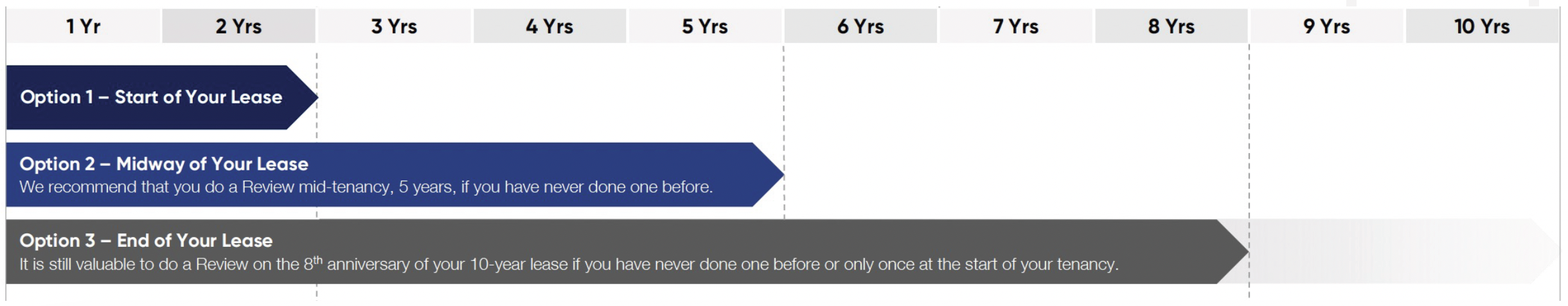

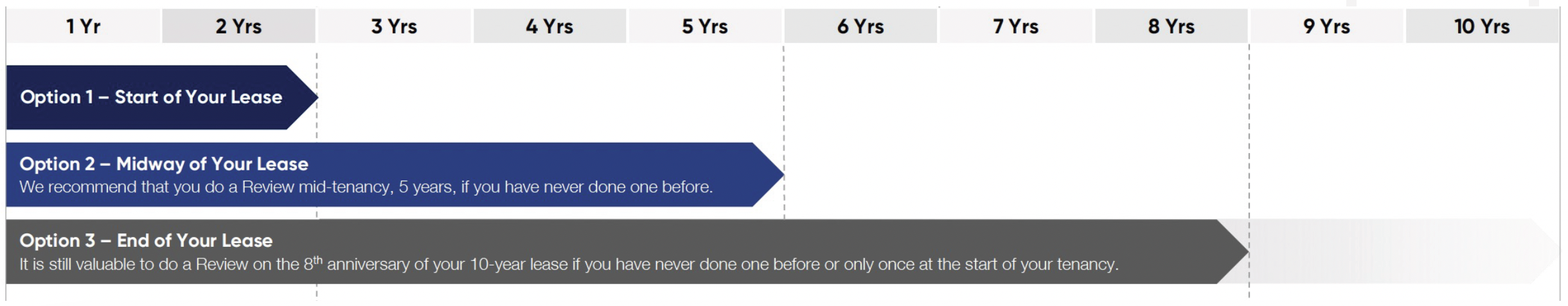

Scenario 2: if you, the tenant, have a 10-year lease:

Ultimately, it comes down to you, the client, to determine which option would be the most conducive to your overall success. As charges made in error are fairly commonplace, neglecting the necessity of a Lease Expense Review increases your susceptibility to financial vulnerability, even precarity. Performing a Lease Expense Review is a sure-fire method in preserving your best interests and putting money back in your pocket.

For more information, please visit: https://www.cresatoronto.com/2023-lease-expense-review

From errors in accounting software to changes in “cosmetic” capital improvements, discrepancies are bound to occur. It is then up to you, the occupier, to uphold the conditions of your lease to guarantee your continued success.

To ensure consistent compliance with certainty, we recommend that clients undergo a desktop review annually. We realize, however, that the feasibility of such a process varies from client to client. Keeping this in mind, we have discerned the three ideal stages to consider:

01. Start of the Lease

When moving into a new space, it is best practice to ensure that the lease has been administered correctly. For a five-year lease, we would suggest a lease review at the one-year mark; for a ten-year, two. The old axiom remains true: the earlier the better. Detection of incorrect calculations upfront will undoubtedly yield significant savings in the future. In taking action early on, these savings will become increasingly notable in the years to come.02. Middle of the Lease

Once you are at the mid-way point of your lease, it is essential to take a more exhaustive look at your past and current billing practices. When in a long-term lease, it is common for your circumstances to have changed since the initial signing — landlord’s processes change, buildings get remeasured, BOMA standards shift, just to name a few. To ensure compliance and reveal potential savings, it is strongly advisable that you conduct a thorough review as nearly 70% of of the documents reviewed by our lease expense analysts contained common errors.03. End of the Lease

As you approach the end of your lease term, the necessity of a Lease Expense Review may not be as apparent. Even if you are considering a new space, the decision to review the conditions of your lease may be beneficial. Another comprehensive analysis may reveal past discrepancies and compel your landlord to recompense the difference. If you were to instead renew your lease, a Lease Expense Review would offer strong leverage on the tenants’ side and facilitate room for renegotiation.Ideal Timeframes for a Lease Expense Review

Scenario 1: if you, the tenant, have a 5-year lease:

Scenario 2: if you, the tenant, have a 10-year lease:

Takeaway

Ultimately, it comes down to you, the client, to determine which option would be the most conducive to your overall success. As charges made in error are fairly commonplace, neglecting the necessity of a Lease Expense Review increases your susceptibility to financial vulnerability, even precarity. Performing a Lease Expense Review is a sure-fire method in preserving your best interests and putting money back in your pocket.

For more information, please visit: https://www.cresatoronto.com/2023-lease-expense-review